Audi is pausing production of a raft of its models due to parts shortages caused by Russia’s invasion of Ukraine.

Automobilwoche reports the Ingolstadt marque has sent a letter to European dealers advising production of various models will be stopped for days or weeks.

The letter reportedly called out the Q4 e-tron, A4, A5, A6, A7, TT, Q7 and Q8 as being particularly affected.

It has warned dealers of “significantly longer delivery times” for these models.

We’ve contacted Audi Australia to confirm the local implications to waiting times and supply levels.

Production will reportedly resume for the e-tron GT and R8 on March 28 and the A6 and A7 on April 4.

A single shift of production will reportedly resume for the A4 and A5 at Ingolstadt on April 4, with the second shift returning the following week.

Limited production will reportedly resume for the Q4 e-tron, TT and Q8 by mid-April.

Other Audi models like the A1, A3, Q5 and A8 are reportedly only affected to a minor extent, though Audi has told dealers not all engine variants are available.

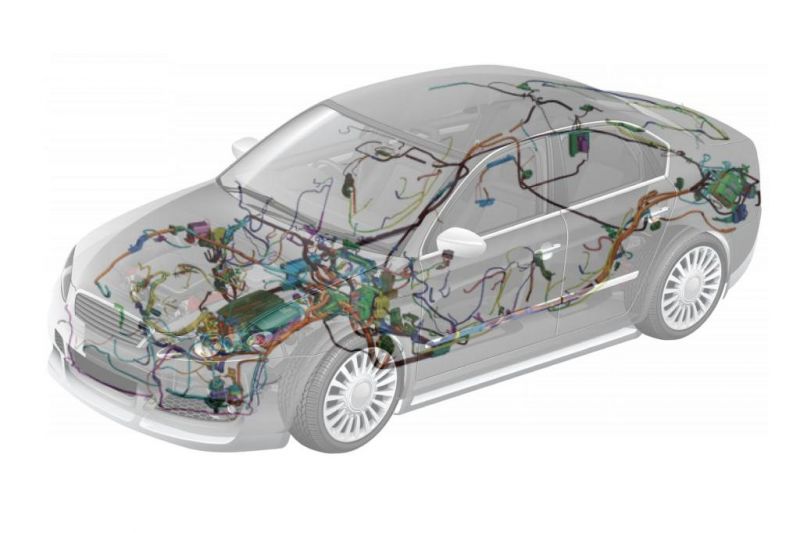

Wiring harness supply is a particular pain point for Audi.

Several carmakers source wiring harnesses from suppliers such as Leoni, Fujikura and Nexans in Ukraine, due to the country’s geographic proximity to their factories, plus its lower labour costs and skilled workforce.

Reuters reports harnesses are the most critical automotive component exported to the European Union from Ukraine, accounting for nearly seven per cent of all imports of this product.

Wiring harnesses bundle up to 5km of cables in the average car, and are unique to a vehicle model. It could take months for suppliers to increase production capacity at other locations.

The Volkswagen Group has been trying to source additional wiring harnesses from Romania, Hungary, Tunisia, Morocco, Mexico and China, though its Skoda brand said in a 2021 earnings presentation this week its Ukrainian supplier has resumed production.

It’s not just Ukraine that automakers rely on for components. Russia is the world’s third-largest supplier of nickel, used in electric vehicle batteries. The country also produces 40 per cent of the world’s palladium.

MORE: Automakers continue to grapple with Russian invasion-related shortages

The knock-on effect of Russia’s invasion of Ukraine could be pricier electric vehicles.

A report from S&P Global Mobility says raw materials costs for EV batteries could soar, increasing by $8000 per vehicle with the Tesla Model Y and $11,000 per vehicle with the Mercedes-Benz EQS.

Automakers had been gravitating towards nickel as a replacement for cobalt, as human rights abuses in Congo – the world’s leading supplier of cobalt – became well-publicised.

S&P Global Mobility has lowered its global vehicle production forecast by 2.6 million units for 2022. It projects next year will also see an identical decline in overall volume.