Damion Smy

Nissan Juke EV will use Leaf platform, due in 2026 - report

11 Hours Ago

Senior Contributor

Honda Australia, one of the first two major car brands to cop flack for shifting away from conventional franchise dealers and towards a new ‘agency’ hybrid sales model, has strongly criticised what it considers premature criticism of the strategy from the dealer lobby.

From July 1 this year, Honda pruned its showroom network and no longer wholesales cars to franchisees.

This means prices are set by Honda, and applied nationally. Customers in return get access to a national inventory and thereby need not shop around at multiple dealers.

The issue of agency model versus traditional franchise dealer models, where haggling is the norm, lies at the heart of a massive blue between the nation’s dealers (represented by a body called the AADA) and the car brands (represented by the FCAI).

It’s even got to the point where a majority of Mercedes-Benz’s dealers are taking it to federal court seeking $650 million in compensation over projected loss of income and to make up for decades of investment. The German luxury giant will adopt a similar model to Honda in January 2022.

So now we’ve set the scene, what’s Honda talking about?

The July 1 change was described as “probably the biggest change” in the brand’s history Down Under. The brand now sells cars at 90 locations called Honda Centres, managed by 47 owners. Before it announced the switch to an agency model, Honda had 106 dealers.

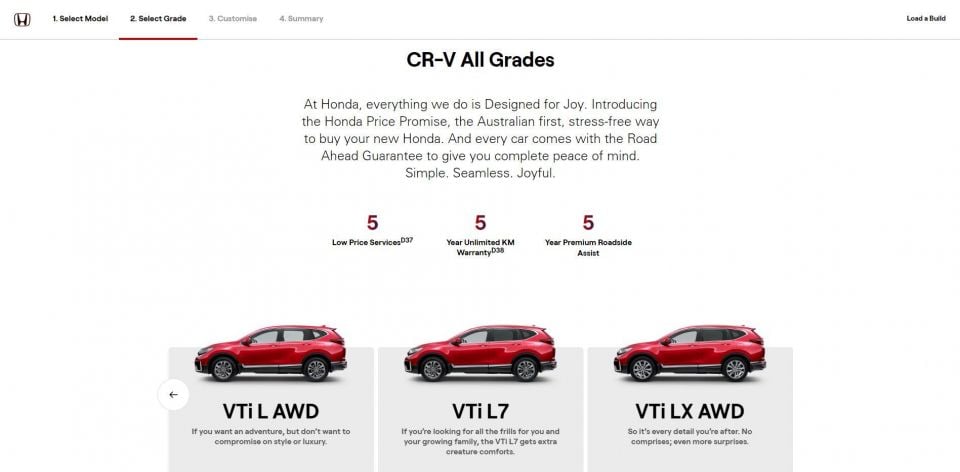

The move to an agency model is part of a plan to stop selling cars for the sake of volume, and instead focus on selling a lower number of more profitable, higher-spec cars.

Chasing volume in Australian market conditions was seen as a road to nowhere by the Honda brass. Honda Australia sold 51,525 cars in 2018, before deliveries dropped to 43,868 in 2019, and just 29,040 in Coronavirus-hit 2020.

Annual sales under the new model are expected to drop further, to 1650 cars per month – or just shy of 20,000 sales per year.

However in the three months since adopting agency it has averaged a combined average monthly haul of only 896 units. Is this agency related? Honda’s product range has been slashed back and its core products are also nearing replacement, so there are clearly numerous factors.

MORE: Honda to slash dealers, sales volume by July 2021

Australian Automotive Dealer Association (AADA) chief executive James Voortman just last week said “the recent experience from Honda shows unequivocally that prices will go up, competition will go down”.

“Consumers have voted with their feet and it is the only major car brand experiencing a decrease in sales in the last quarter. Consumers are not crying out for this change. They are just plain crying.

“Where in any industry in the world has there ever been an example of monopoly pricing delivering a better consumer outcome?”

MORE: Australian dealer association savages Mercedes-Benz, FCAI over ‘fake news’

Honda argues the pricing issue, insisting that across the 18 individual grades that make up its current range, the largest “straight price increase” was $300. This is because it now advertises drive-away prices including a few grand worth of State taxes, it claims.

“These on-road costs are part of the final transaction price for every new vehicle sold in Australia and do not in any way constitute a price rise under Honda’s new business model,” it claims.

Dealer advocates retort that removing any scope for haggling drives up real-world prices, which in some cases is correct – if you’re a good haggler and market conditions are favourable (which right now, with stock shortages, they generally are not).

“We knew, and our business partners knew, there would be a period of transition following such a significant change to the way the Honda brand operates in Australia,” wrote a Honda brand spokesperson today.

“To assess its success or otherwise after just three months – a period that has also been impacted by the global pandemic, production shortages and supply chain delays, varying state, regional and local government restrictions, and business closures – is premature at best.

“When you’ve been doing something the same way for over 52 years – or over 624 months – attempting to measure the viability of a new way of doing things after just three months, has little merit. It is nothing more than a sample and it is statistically inconclusive.

“Calling out one single metric in the form of retail sales numbers as being the ONLY measure of success, is easy to do, but it in no way accurately captures the true picture of what is occurring at Honda Centres around the country.

“Since July 1, more than 3500 customers have experienced the new Honda way and the feedback has been overwhelmingly positive. Customers have commented favourably on the ease of the process, how it is both hassle and stress-free.

“Despite an enormous level of change in how the Honda Australia business interacts with the national network of Honda Centres, the launch and transition phase to date has been executed almost perfectly, with 99 per cent of the new systems available, operating and stable over the first few months.

“That is unequivocally an outstanding result, given the scale and complexity of the changes.

“The new car business is a complex, multi-faceted, challenging and rewarding industry to be involved in and despite the naysayers, the Honda team continues to build on the strong results achieved so far, is energised for the future and ready to offer customers a simple, straightforward and enjoyable purchase and ownership experience.”

What do you think? Is criticism of Honda’s model premature? Or is falling short of sales goals over the first three months proof that this new model needs refining?

MORE: Honda Australia details agency sales, as new model takes force MORE: How will Honda’s new Australian sales model work?

Where expert car reviews meet expert car buying – CarExpert gives you trusted advice, personalised service and real savings on your next new car.

Damion Smy

11 Hours Ago

Damion Smy

14 Hours Ago

Damion Smy

18 Hours Ago

Damion Smy

20 Hours Ago

Damion Smy

20 Hours Ago

Damion Smy

21 Hours Ago