Famous companies often have owners with diverse interests. This is especially true with conglomerates, some of which have businesses in every conceivable industry and field.

Mahindra & Mahindra is one of the most stark examples of this, with its core business of producing farm equipment such as tractors heavily contrasting with the development of ultra-exclusive hypercars such as the Pininfarina Battista.

In addition to this, parent company Mahindra Group retains ownership stakes in enterprises across industries as diverse as financial services, hospitality, IT consulting, and defence.

Mahindra & Mahindra currently has a market capitalisation in the region of US$13 billion, smaller than Japanese competitors such as Subaru and rival Tata Motors, but larger than other household brands such as Renault and Mazda.

History

The 1940s saw the UK emerge victorious but battered from the Second World War. It paid a heavy price, with the subsequent independence of the crown jewel in the British Empire, India, two years later in 1947.

These events also set the stage for the early history of Mahindra.

Formed in 1945 as Mahindra & Mohammed by the Mahindra brothers and associate Ghulam Mohammed in the Indian state of Punjab, the company commenced operations as a steel trading business.

As part of Indian independence shortly afterwards, Punjab was partitioned between India and the new state of Pakistan. This caused Mohammed to leave the business, with the firm’s name subsequently changed to Mahindra & Mahindra.

The company began to export steel overseas, and following various successes in this area, decided to enter into automotive manufacturing, with the company’s first operations being the local assembly of Jeeps following the awarding of a contract from the American Willys Corporation that would export the vehicles as kits in semi knock-down (SKD) condition.

An initial batch of 75 vehicles were assembled in 1947, before regular production commenced in 1949.

The Jeep was well suited to India’s rough roads and agricultural economy, and the company saw a further opportunity in the manufacture of commercial vehicles and equipment that could assist the independent nation’s farmers.

Mahindra & Mahindra formed a partnership with another American company, International Harvester, in 1961. The result was a joint venture dedicated to the domestic manufacture of tractors, known as the International Tractor Company of India.

Mahindra bought out International Harvester’s share in 1977, and was able to become the largest tractor manufacturer in India by 1983.

The company continued to grow over the next decades, and more recently has shown an appetite for acquisitions as part of its ambitions to ‘rise’ on the global stage. The first phase of this was the purchase of Korean OEM SsangYong Motor Company in 2011 for approximately US$460 million.

Mahindra’s automotive lineup at the time consisted largely of SUVs, and it was hoped that the acquisition of SsangYong, another SUV-focused firm, would give the Indian brand expertise in developing more modernised diesel powertrains, greater engineering nous, as well as a better dealership network in regions such as Russia.

Motorcycles and scooters remain critically important as a mode of transport in India, and with cars still out of reach for many, often take the role of family transport. Mahindra decided to enter this market in 2008 by taking over local motorcycle company Kinetic Engineering.

Having attained a significant share of the Indian market, the company attempted to expand its scooters and motorcycles business globally, with a particular focus on the European market. Of course, it wasn’t well known outside India for this, and so the most efficient process to expand internationally was through the purchase of a more valuable brand, Peugeot Motorcycles.

Mahindra & Mahindra bought an initial 51 per cent stake from then-owner Groupe PSA in early 2015, and the outstanding shares were acquired by 2020. Nevertheless, Peugeot (now under Stellantis ownership) retains use of its branding, which is licensed to Mahindra, and also continues to assist in the design and engineering of Peugeot branded two-wheeler products.

Later in December 2015, the firm also acquired a 76 per cent stake in legendary Italian automotive design studio and coachbuilder Pininfarina, in a move that would assist in overhauling the design of the company’s entire automotive portfolio and build partnerships with European automotive OEMs.

Mahindra in Australia

It originally intended to export vehicles to Australia in the 1980s, but Mahindra as a brand finally launched locally in 1990.

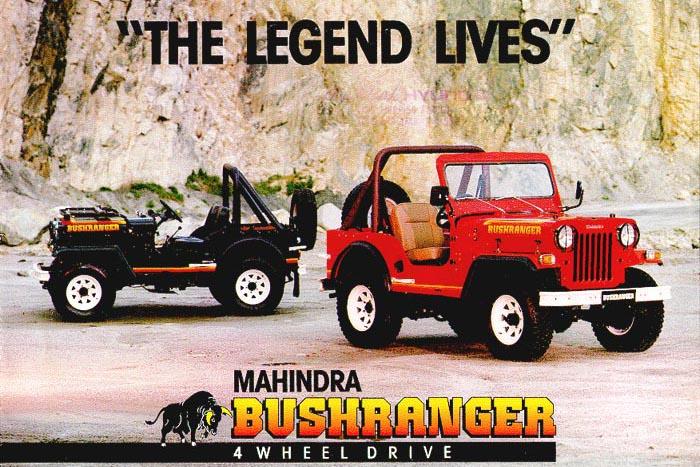

Its first vehicle sold here was a slightly modernised version of the 1950s civilian Willys CJ-3B Jeep, produced using Indian parts.

Available in two models, the basic Stockman and slightly more comfortable Bushranger, the 4×4 featured a 2.1L Peugeot XDP 4.90 diesel engine producing 47kW of power and 121Nm of torque, with special introductory prices of $13,000 for the agricultural Stockman and $15,990 for the more recreational Bushranger.

More recently, the company has imported the Pik-Up and Genio (now discontinued in Australia) ute and light truck respectively, as well as the XUV500 seven-seat medium SUV, that is priced similarly to small SUVs from more popular brands.

Perhaps the most controversial recent story regarding Mahindra is its attempt to launch its latest cut-price 4×4, the Thar. Intended to directly compete against the Suzuki Jimny, Stellantis attempted to stop Mahindra from launching the Thar in Australia due to its resemblance to the Jeep Wrangler.

Consequently, Mahindra has put its plans to import the vehicle on hold. The irony of this is not lost, especially given Willys licensed Mahindra to manufacture early Jeep models in India during the ’50s and ’60s.

Future

Perhaps the most exciting vehicle that Mahindra & Mahindra will launch is the Pininfarina Battista, an EV hypercar sharing its powertrain and mechanicals with the Rimac Nevera, clothed in a slightly different design.

Nevertheless, this will be one of the few models that will be branded as a Pininfarina (rather than designed by the firm but sold under another OEM’s name).

Unfortunately, Mahindra & Mahindra’s ownership of SsangYong has not borne much success, with the Korean company entering bankruptcy protection in South Korea, and Mahindra attempting to offload the business to another investor.

Most recently, reports have emerged American automotive distribution business HAAH and related entity Cardinal One Motors intends to purchase the brand from Mahindra, with a goal to import their cars to the North American market.

Only time will tell whether these plans will be successful and revitalise the company.