Nissan’s new management this week emphatically dusted its hands of the business plan enacted under its fallen former company head, Carlos Ghosn, and outlined its intentions for the next four years.

Reading between the lines from new CEO Makoto Uchida’s address, Nissan followed a path laid down in the fable of Icarus, whose ego was the death of him. It stretched itself too far, too quickly, and into the wrong places.

The result was an aged product range in neglected core markets that had to be discounted to move, an inefficient factory network, and a lack of “Nissan-ness” in the product. The reported distrust towards alliance partner Renault comes as little shock with this perspective.

The last business plan announced nine years ago “was based on expectation of growing demand as well as the need for increased production capacity outside Japan with a focus on emerging markets”, Uchida-san said.

“In line with this we pursued a strategy of expansion. Although we sowed the seeds of the plan we were not able to grow them effectively and as a result Nissan was unable to harvest.

“Additionally, due to the massive investments made in markets around the world, Nissan was unable to launch new products in key markets, particularly in Japan.

“About two years ago we started shifting away from this expansion strategy, however we have been left in a situation where we have global production capacity of around 7 million units annually but annual sales of around 5 million units.

“To continue our business and generate a profit under these conditions has been extremely difficult.”

But it claims to have patched things up with Renault, and by appearances is once again part of a united front alongside the third member of the triumvirate Mitsubishi, in which Nissan owns about a third of the stock.

And those much-needed new products to replace ancient models like the 370Z, US Frontier, and the Pathfinder are coming, from the Ariya crossover EV to the reborn Z coupe teased here.

Moving forward, all products will be made on common Alliance platforms with shared drivetrains, and in some cases will share doors and other exterior bits. Nissan has the role of ‘leader’ in the battery electric vehicle (BEV) space, and ‘follower’ in plug-in hybrid (PHEV) and small European SUV development.

You can read our pieces detailing Nissan’s plan to shutter plants and cut costs here, and the path to be taken by the Alliance here. But for those who’re just now catching up, here’s a digestible breakdown of precisely what Nissan wants to do under its new management between now and 2023.

- Cut worldwide production capacity by 20 per cent to 5.4 million units a year, achieve plant utilisation rate above 80 per cent, close its Barcelona and Indonesia plants and “consolidate” its North American plants to make “core models” only.

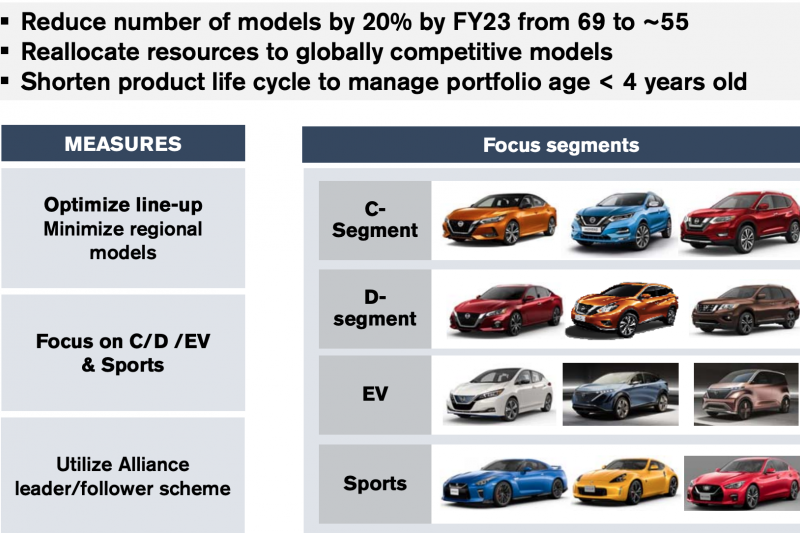

- Reduce its global product line-up by 20 per cent (from 69 to fewer than 55 models) over the period. Use Alliance partners to share more resources, including production, models, and technologies, cutting vehicle development costs by up to 40 per cent. Cut average product age from above five years to below four years.

- Focus on “core operations in the markets of Japan, China and North America” while “leveraging the Alliance assets to maintain Nissan’s business at appropriate operational level in South America, ASEAN and Europe”. Exit South Korea where Renault-Samsung has presence, cull the Datsun brand in Russia.

- Paying all attention to global core model segments including enhanced C and D segment vehicles, electric vehicles, sport cars. Introduce 12 models in the next 18 months including 2021 Ariya EV crossover, new 2020 X-Trail/Rogue (in June this year), new Frontier pickup, and new Pathfinder/Infiniti QX60 twins.

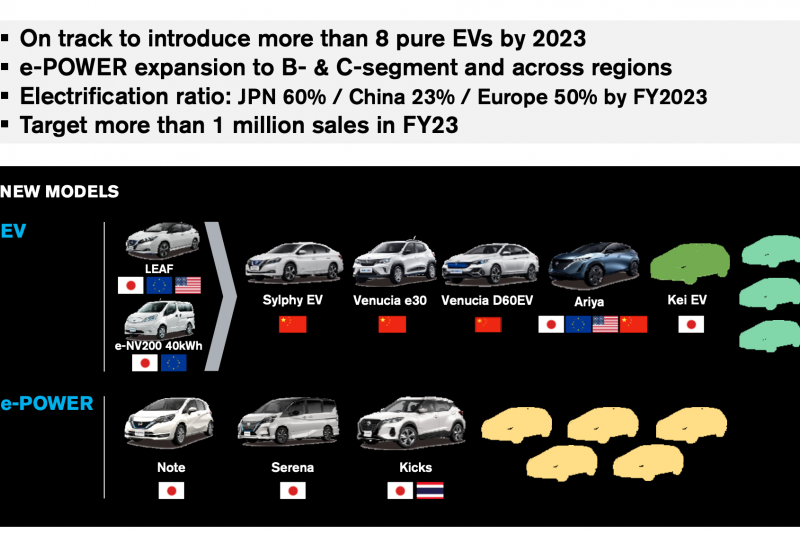

- Expanding presence in EVs and electric-motor-driven cars, including e-Power range-extender hybrids, with more than one million annual electrified sales and eight pure EVs on sale by the end of FY23. Two new EVs and four new e-Power vehicles in Japan, two new EVs and six e-Power vehicles in China, and three new EVs, two e-Power hybrids and one PHEV (likely the X-Trail based on the Mitsubishi Outlander) in Europe.

- Introducing ProPILOT driver-assistance (level two autonomous) system in more than 20 models in 20 markets, targeting more than 1.5 million units to be equipped with this system per year by the end of FY23.