Ford CEO Jim Farley says Tesla’s repeated price cuts resembles Henry Ford’s strategy with the Model T, which nearly led the Blue Oval to file for bankruptcy.

In an interview with the Fully Charged Podcast, CEO Jim Farley claims Tesla’s pricing strategy is designed to commoditise its vehicles which will ultimately repel customers.

“The next big test turns out to be their heavy discounting to stimulate demand, which is the sugar high and it continues to deteriorate the elasticity,” said Ford CEO Jim Farley.

“Less and less people are signing up as you cut the price. This is what Henry Ford found out with the Model T — that you commoditise your product when you’re telling people, hey, the price is what really matters.”

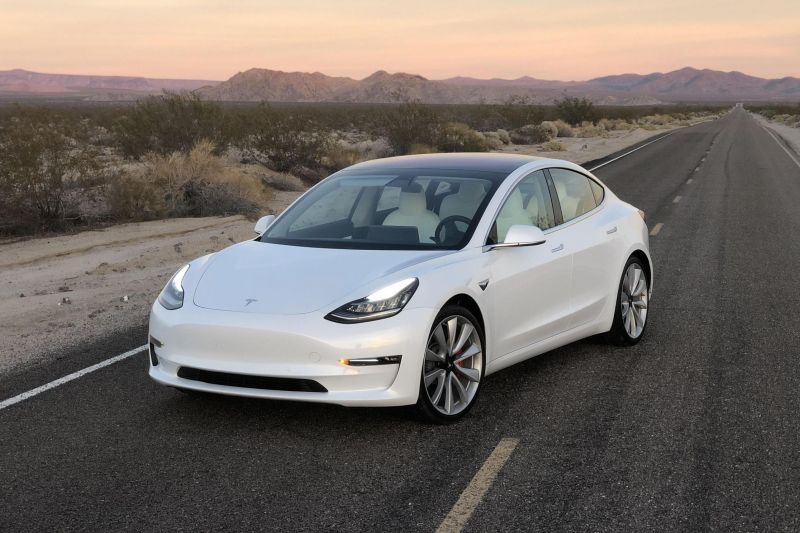

Earlier this month, Tesla revealed its second quarter earnings for 2023 which saw the brand’s operating margin take a hit partly as a result of the Model 3 and Model Y price cuts.

In the second quarter of 2023, Tesla reported a 9.6 per cent operating margin which was down compared to 11.4 per cent in Q1 of 2023 and 14.6 per cent in Q2 of 2022.

The brand reported its lowest overall gross margin in 16 quarters with 18.2 per cent for the April-June period. This figure, however, still sits above the industry average.

It’s worth noting that in July, Tesla joined 15 Chinese automakers in signing a pledge to effectively end an electric car price war there, and promote “core socialist values”.

Mr Farley told the Fully Charged Podcast that Tesla’s current pricing strategy resembles what Henry Ford did with the Model T in the 1900s.

In 1909 it was priced at US$825. Adjusted for inflation, that works out to US$26,871 today (A$40,108).

After seven of years of production, Henry Ford reduced the price to $345 (current equivalent cost US$9278/AU$14,000) which at the time caused a 62 per cent increase in sales.

The price for the Model T fluctuated almost every year from when it went into production in 1908 until it was discontinued in 1927.

According to current CEO Jim Farley, the price fluctuations nearly caused Henry Ford to file for bankruptcy.

Mr Farley agreed that Henry Ford’s Model T failed strategy could teach Tesla an important lesson in what not to do.

As Ford continues to move into the electrification space, Mr Farley says the brand’s main rivals are not only Tesla, but also Chinese automakers like BYD and Geely.

Although these companies all signed the pledge in China to end a price war on electric vehicles, Mr Farley says legacy brands like Ford and Volkswagen will still struggle to keep up.

“The people winning aren’t the western brands in China. [It’s] Changan, SAIC, Geely, BYD, Nio, XPeng,” Mr Farley said.

Mr Farley claims brands in China that are doing well have not traditionally produced internal-combustion engine vehicles.

“What’s interesting is that in China… those that are successful in the EV business that had ICE products like Geely, and SAIC and Changan, they all started new brands because they realised that these are digital products,” he said.

“They knew that as long as they had ICE vehicles and EVs in the same brand they would fail so they started sub-brands, every one of them, has started sub-brands that aren’t like their main company.”

Mr Farley went on to say that legacy brands’ biggest challenge will be to create software that is on par with Chinese manufacturers that create systems in-house.