Volkswagen brand CEO Thomas Schäfer says the Group’s four upcoming MEB Entry models will be profitable, even if one of them will have a sharp sub-€25,000 (A$41,000) base price.

“We cannot have margins below six per cent,” he told Automotive News Europe.

“With the scale we have with four vehicles from three brands [on the same MEB Entry platform] — two from VW, one from Cupra and one from Skoda — I guarantee we can.

“We are not a charity. We intend to make money.”

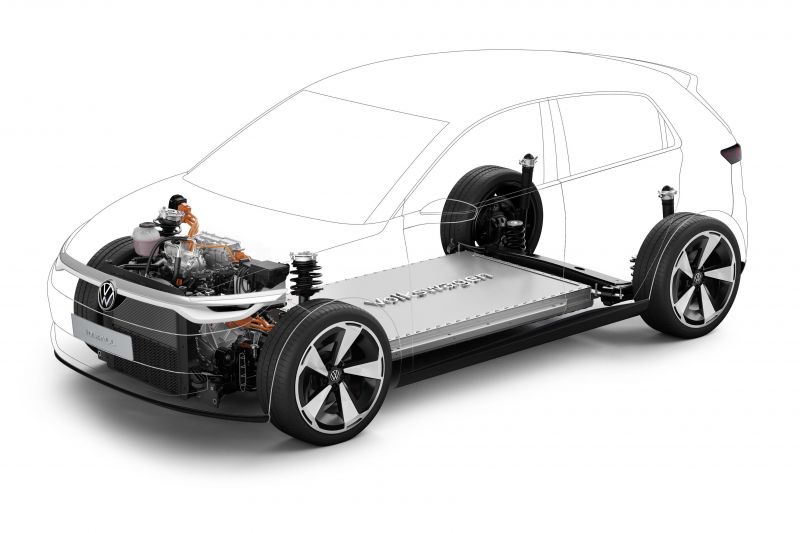

In addition to production versions of the Volkswagen ID. 2all and Cupra UrbanRebel concepts, the MEB Entry platform will underpin a “SUV-ish vehicle” for Volkswagen and an SUV for Skoda.

The first MEB Entry models will enter production in 2025.

The production ID. 2all has been developed as “mainly a European vehicle” and won’t be sold in hatchback-averse China, but Mr Schäfer says MEB Entry models “will be rolled out globally, probably”. The UrbanRebel has been locked in for a local launch in 2025.

Volkswagen is already discussing a GTI version of the production ID. 2all.

Only the production ID. 2all will have a base price under €25,000, with the others to have a higher cost of entry.

The new VW hatch won’t be the cheapest Volkswagen EV for long, with Mr Schäfer reiterating plans for a sub-€20,000 (A$32,000) EV “to come by 2026-27 at the latest”, though it may not use the MEB Entry platform.

Volkswagen is still weighing options for this vehicle, which is being developed jointly by the Volkswagen and Skoda brands.

When asked how the company could make money on such a car, Mr Schäfer said, “Either you solve the riddle with scale, downsize the battery, or you find a partner and scale it even more.”

“It’s not clear yet. We have four working streams in parallel at the moment,” he added.

This entry-level EV will effectively replace the e-Up!, which will be axed by mid-2024 due to new UNECE rules for cybersecurity.

There’s a chance it could indirectly replace the Polo, too, should strict proposed Euro 7 emissions standards make the petrol-powered hatch prohibitively expensive to produce, though Mr Schäfer has a feeling there’s an “amicable solution on the horizon”.

While Mr Schäfer says it’s too early to talk specifics on this sub-€20,000 vehicle, development of the four initial MEB Entry models is well underway.

All four will be produced in Spain: the production ID. 2all and UrbanRebel in Martorell, the other Volkswagen and Skoda in Pamplona.

Both facilities are being retooled to produce electric vehicles, with batteries being produced in a new plant not too far away in Sagunto.

Volkswagen subsidiary SEAT S.A.’s target for the Martorell plant alone is an annual production volume of 500,000 vehicles.

The Sagunto battery plant won’t be online until 2026, so Mr Schäfer says MEB Entry vehicles will initially use nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) batteries sourced from other Volkswagen factories and from Northvolt.

He also said the new Unified prismatic battery cells from its PowerCo subsidiary will be scaled across all Volkswagen Group electric vehicles, giving it a cost advantage while serving as “the industry standard going forward”.

The Volkswagen Group will also sell these Unified cells to other manufacturers.