Damion Smy

2 Days Ago

Cheap and cheerful new cars are nowhere near as popular as they used to be. The numbers are eye-opening.

Senior Contributor

Senior Contributor

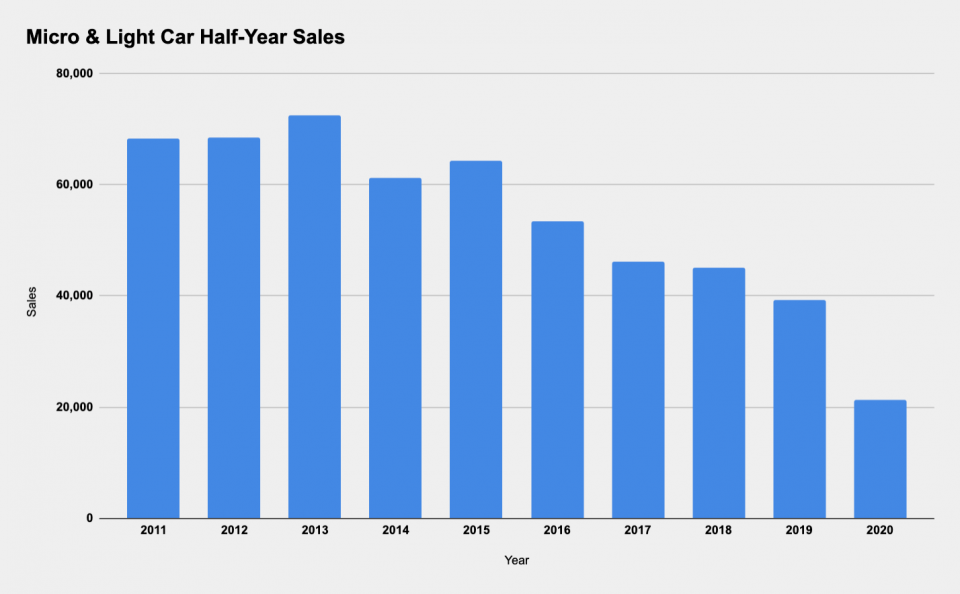

We all know why the Australian new-car market has plummeted by 20 per cent in 2020, compared the same period in 2019. Fires, floods, economic confidence, exchange rates, all topped off with a global pandemic – nothing conducive to car sales seems to have happened.

But the overall market decline is nothing compared to the decline in the ‘Micro Car’ and ‘Light Car’ segments, as defined by the Federal Chamber of Automotive Industries. Sales in the two smallest and cheapest segments are down 42 per cent and 46 per cent respectively.

It comes at a time where more car brands are either abandoning these segments entirely – Hyundai has axed the Accent, Honda won’t replace the Jazz, Ford flicked all Fiestas but the hot ST – or pushing up the price in return for more spec, as we have seen with the Mazda 2.

There are a few factors here. The late-model used-car market is flourishing, as this ABC report shows. People are clearly buying two-year old Corollas and i30s rather than smaller, newer models.

There’s also less incentive for manufacturers to push these vehicles, because margins are becoming ever more paper-thin or even nonexistent.

A Hyundai executive admitted to this writer recently that the Accent, at $16,990 near the end of its life cycle when development costs should have been amortised, was still unprofitable.

Of course, light cars have have never really been money-makers, until you count accessories and servicing. But they used to be levers to get coveted young buyers into your brand, and with the right customer care you’d keep them at trade-up time. But this model doesn’t slide anymore.

Then there is the proliferation of captive finance programs with sharp comparison rates that make stepping up into a more expensive vehicle seem easier, because the repayments can be broken down weekly. Hence the growth in market-share of small SUVs in particular.

Most of these little SUVs are based on light car platforms anyway, and can command higher margins. Therefore they are the subject of more marketing, and more regular upgrades to sweeten them.

That doesn’t mean the market is dead. A brand new Toyota Yaris is coming this year, with a new hybrid option that’ll make it Australia’s most frugal non-electric car.

If any brand can buck the trend, it’s sales-leader Toyota, which owns more than 20 per cent total market share.

There have also been opportunistic plays from a few brands that are able to sell their cars cheaply. Examples are China’s MG 3, which combines bargain pricing with an automatic transmission and a touchscreen, and in so doing has grown sales by 76 per cent this year.

It’s to 2020 what the Hyundai Excel was to the 1990s, in my opinion.

And there’s the India-made Suzuki Baleno, the Swift’s less-fashionable but more practical sibling that offers a similar no-frills space-for-money proposition as that old Accent did. Its sales have almost tripled this year.

And while its sales have reduced, Kia has become the leader at the cheapest end of the market, with its Picanto and Rio pairing up for 4385 sales out of the combined 20,299 total.

That’s more than 20 per cent market share for a brand that was on the nose once upon a time, but is now driven by a large number of younger and more fashionable people who traditionally shop in these segments.

Here are some tables showing how the micro- and light-car market is travelling in 2020. The ‘H1’ stand for the first-half of a given year.

| H1 2020 sales | % +/- over H1 2019 | |

|---|---|---|

| Toyota Yaris (new model soon) | 3234 | -29.1 |

| MG 3 | 2913 | +76.4 |

| Kia Rio | 2688 | -25.3 |

| Suzuki Swift | 2317 | -42.0 |

| Suzuki Baleno | 1767 | +167.3 |

| Kia Picanto | 1697 | -45.2 |

| Volkswagen Polo | 1608 | -46.3 |

| Mazda 2 | 1412 | -71.9 |

| Honda Jazz | 1290 | -62.2 |

| Mini hatch | 736 | -22.1 |

| Skoda Fabia | 356 | +3.5 |

| Mitsubishi Mirage | 298 | -9.4 |

| Audi A1 | 274 | +36.3 |

| Fiat 500/Abarth 595 | 244 | -42.7 |

| Honda City (retired) | 135 | -67.0 |

| Ford Fiesta ST | 94 | New model |

| Toyota Prius C (retired) | 73 | -66.5 |

| Hyundai Accent (retired) | 61 | -99.1 |

| Citroen C3 | 28 | -15.2 |

| Renault Clio (new model soon) | 22 | -94.3 |

| Renault Zoe EV | 8 | +300.0 |

| TOTAL | 21,345 | -45.6 |

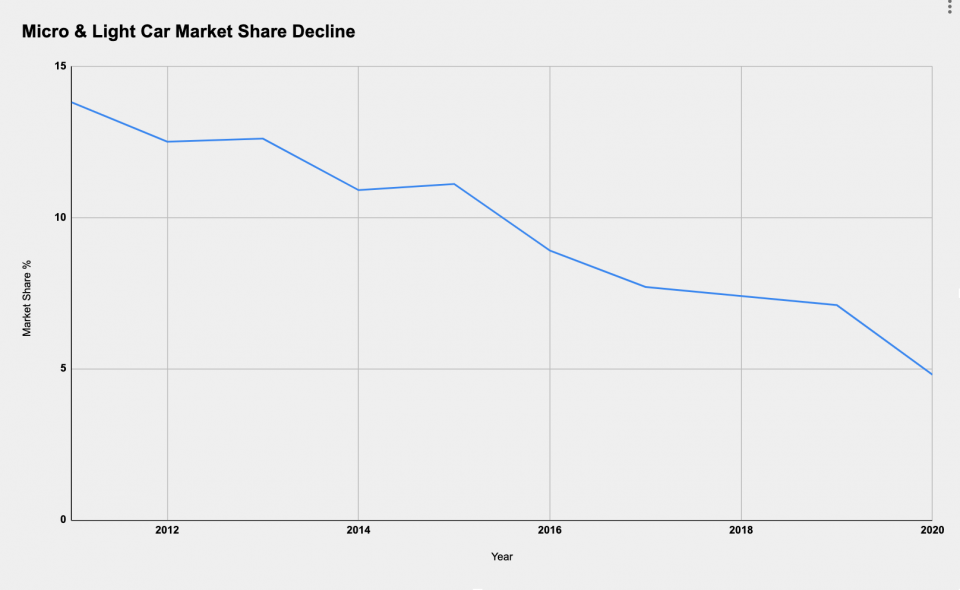

Now, for context. Let’s track the total market share of these baby cars combined over the past decade, and see how their popularity has changed.

In H1 of 2020 their combined share of the overall new-vehicle market was 4.8 per cent. Over the same period in 2019 the corresponding figure was 7.1 per cent, but as recently as 2011 these small and cheap cars owned 13.8 per cent market share.

If you have any questions – perhaps you want to know how your car is tracking – ask in the comments and a member of the CarExpert team will respond.

MORE: H1 2020 market wrap MORE: VFACTS June wrap MORE: Most popular Medium SUVs MORE: Luxury market wrap MORE: Most popular utes MORE: Winners and losers

Damion Smy

2 Days Ago

Matt Campbell

21 Hours Ago

Josh Nevett

18 Hours Ago

Josh Nevett

18 Hours Ago

Damion Smy

18 Hours Ago

Max Davies

17 Hours Ago