William Stopford

Hyundai Ioniq 6 facelift delayed, but hot N arriving sooner

2 Hours Ago

We all need car insurance, but what options are there and how are our premiums calculated?

Contributor

Contributor

The basic concept behind insurance is that an insurance company guarantees to compensate someone if they suffer a loss, in exchange for a payment known as a premium. Within the context of car insurance, this loss can include damage to the vehicle or injury suffered by an occupant in the event of a crash.

In Australia, all car owners are required to have Compulsory Third Party (CTP) insurance. Known as Motor Accident Injuries (MAI) insurance in the ACT, this is a basic level of cover and is popularly known as the Green Slip.

It provides compensation for any financial liability you may have (if you are at fault) for the injury or death of other people in the event of an accident. It does not provide any coverage for injuries you may sustain during the collision.

Other types of car insurance build on the basic level of cover offered by CTP insurance.

Third Party Property Damage insurance offers coverage for any damage that your car might cause to other vehicles and property, but does not cover your own vehicle. This type of policy might be suitable if you own a vehicle that isn’t worth much, but would like some level of protection from claims others may lodge against you if their property is damaged.

Third Party Fire and Theft insurance builds on this by also offering coverage for your car in the event that it’s damaged or destroyed by fire, or if it’s stolen.

Comprehensive insurance, as its suggests, offers the most thorough level of cover, and in turn is also the most expensive type of insurance policy with the highest premiums.

In addition to the coverage offered by the policies above, a comprehensive policy covers the cost of repairs or replacement of your own vehicle in the event of an accident, regardless of whether you are at fault. In general, it also covers flood damage and damage from other weather events such as hail.

If you pay for a comprehensive policy, there will generally be an agreement between you and the insurer as to the value of the car in the event that it is written off (i.e. if it is too badly damaged to be repaired, or if the cost of repair would exceed the value of the vehicle).

Specific policies can vary significantly in their coverage depending on the insurer. Before taking out any insurance policy, make sure you read the PDS (Product Disclosure Statement) which will provide further details on what circumstances or the type of damage that is covered. The PDS is available for download from your insurance company’s website.

In the event of an accident, the insurance company may only allow you to take your car to one of its ‘approved’ smash repairers, or offer to compensate up to the value of a quote from one of these approved repairers.

The smash repairer fixes the car for a lower cost in exchange for a guaranteed stream of work from the insurance company. This is usually marketed to the customer as offering a high-quality repair with a warranty. Be sure to check the PDS to see whether your policy requires your car to be fixed at an approved repairer.

Unlike buying household goods or other products off the shelf, there is no one price for all approach to insurance policies.

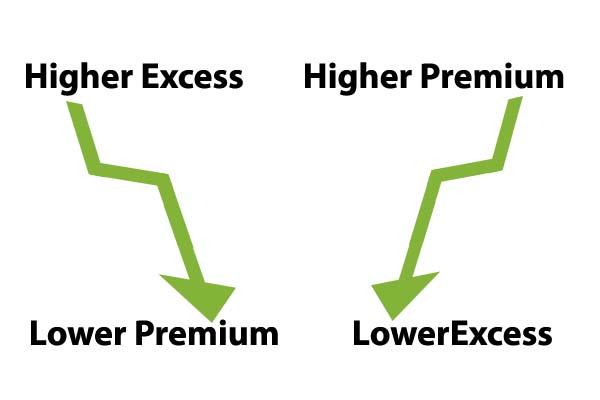

Insurance policies are all about determining the risk the customer may have of actually claiming something against the policy that they have taken out. The higher the likelihood of this occurring, the more expensive the insurance premium.

Insurance companies take a number of factors into account to try and accurately determine this level of risk, and to tailor it as much as possible on a per-customer basis. These factors usually include:

Car insurance companies in Australia can be split between existing, dominant brands and up and coming challengers looking to take market share away from their larger competitors.

The first dominant car insurance company is the Insurance Australia Group (IAG), which has a stable of brands including NRMA, CGU and RACV.

The second is Suncorp, which includes popular brands such as AAMI, APIA, Shannons and GIO.

Challenger companies include Youi and Auto & General (which sells insurance under the Budget Direct brand). Allianz is another key player in the Australian market.

The brands under IAG and Suncorp hold approximately 70 per cent market share of the car insurance industry today.

Insurance companies in Australia must have an internal dispute resolution process which acts as the first port of call in the event of a disagreement. Contact your insurance company for further details about this process.

If you remain unsatisfied with the outcome of your insurer’s internal dispute resolution process, you are able to take the issue to the Australian Financial Complaints Authority (AFCA) which is a not-for-profit agency that serves as an ombudsman for the insurance industry.

In the event that none of the above options produce a satisfactory outcome, seeking legal advice may be another alternative.

William Stopford

2 Hours Ago

William Stopford

2 Hours Ago

Damion Smy

5 Hours Ago

Derek Fung

6 Hours Ago

James Wong

13 Hours Ago

Ben Zachariah

18 Hours Ago