Long waits for new cars and stripped-back equipment lists could be with us until 2024, according to one Volkswagen Group executive.

Speaking with Automotive News Europe, Volkswagen Group finance boss Arno Antlitz said the semiconductor shortage afflicting carmakers isn’t close to finishing up, due to “a structural undersupply in 2022, which is only likely to ease somewhat in the third or fourth quarter”.

“The situation should improve in 2023, but the structural problem will not yet have been fully resolved,” Mr Antlitz told Automotive News.

Carmakers are currently battling an unprecedented combination of challenges when it comes to production.

Having dealt with lockdowns and COVID-19 outbreaks in 2020 and 2021, both of which hit production numbers hard, they’re still dealing with a global shortage of semiconductors – chips essential to making the array of screens and computers in modern cars work.

In Australia, that’s played out in the form of long delays on new cars, higher prices, and some brands removing equipment from their vehicles to get them to customers.

Reports on when the chip crunch will abate vary, but the Volkswagen Group is far from alone in forecasting it will last deep into 2023.

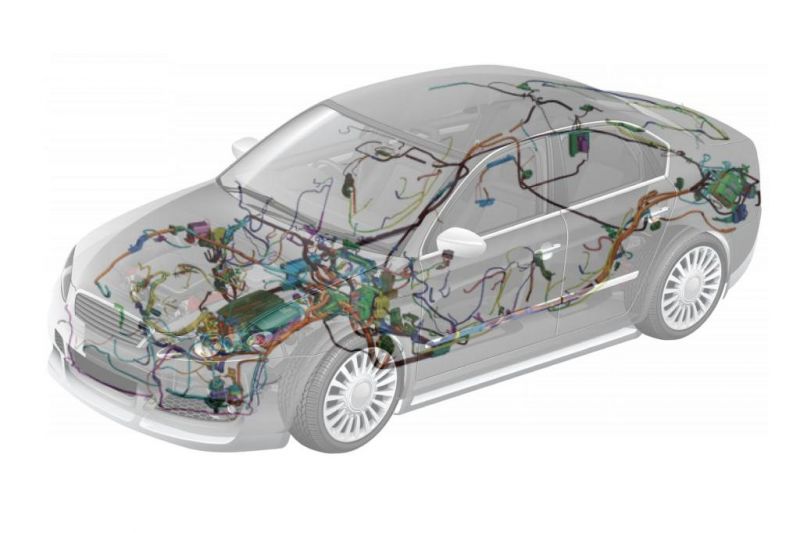

Along with COVID-19 and the related semiconductor crisis, the war in Ukraine has also forced the closure of factories that produce wiring harnesses.

Reuters last month reported BMW and Porsche had been forced to pause production due to a shortage of wiring harnesses.

BMW and the Volkswagen Group source the harnesses from suppliers in western Ukraine, and are among several car companies that have reportedly set up “crisis teams” to manage the disruption to operations caused by the invasion.

Several carmakers source wiring harnesses from suppliers such as Leoni, Fujikura and Nexans in Ukraine, due to the country’s geographic proximity to their factories, plus its lower labour costs and skilled workforce.

Reuters reports harnesses are the most critical automotive component exported to the European Union from Ukraine, accounting for nearly seven per cent of all imports of this product.

Wiring harnesses bundle up to 5km of cables in the average car, and are unique to a vehicle model. It could take months for suppliers to increase production capacity at other locations.