New vehicle sales around the world fell a brutal 39 per cent this March compared to the corresponding month last year, according to data analytics firm JATO.

Sales counted by the firm equalled 5.55 million (rounded), compared to 9.03 million in March 2019. The decline is the largest on record – even at its height in November 2008, the Global Financial Crisis only cut sales 25 per cent.

The total for the first quarter of 2020 already highlights a reduction of 26 per cent compared to Q1 2019, with sales decreasing to 17.42 million units.

Naturally, the COVID-19 pandemic is to blame for the most part. Strict lockdowns in key markets, combined with consumer panic and economic uncertainty, have all been cited as key drivers of the decline.

“This downward trend is not simply due to the restrictions of free movement. The industry is being impacted largely by the uncertainty for the future, and this issue started to arise even before the pandemic took hold” said JATO’s global analyst Felipe Munoz.

“We have to remember that the industry was already operating in a challenging environment, especially towards the end of last year. The trade wars, lower economic growth and tougher emissions regulations came long before the COVID-19 crisis.

“And unlike previous recessions, we’re not just dealing with people’s fears or purchase delays. This time we have to consider that consumers are simply unable to leave their homes.”

China, Europe, and the USA all posted double-digit declines in March.

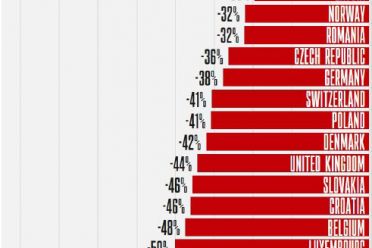

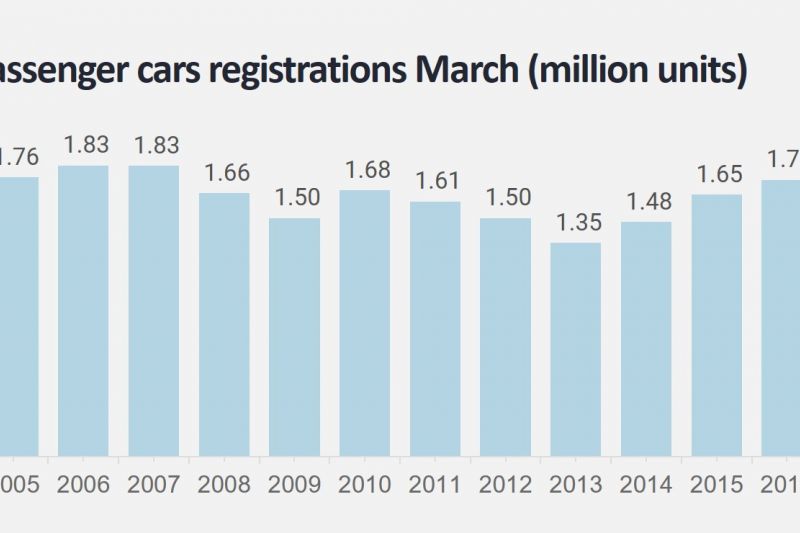

However, Europe was hit the hardest, with the lowest number of sales for March in 38 years. Passenger car registrations there comprised 848,800 units, down by 52 per cent compared to March 2019.

This result follows declines in January and February, taking quarterly volume down to 3.04 million units.

Registrations fell in all 27 European markets, but with varying severity. Sales were significantly hit in Italy, France, Spain, Austria, Ireland, Slovenia, Greece, and Portugal, where the combined volume fell from 634,600 units in March 2019 to 161,800 units last month. That’s a cut of 75 per cent.

However, electric vehicles (classified by JATO as battery EVs, plug-in hybrid EVs and mild-hybrids alike) were able to increase registrations by 15 per cent to 147,500 units in March, posting a new record market share of 17.4 per cent – 10.1 percentage points higher than seen in March 2019.

But it was pure electric cars and plug-in hybrids that drove this growth, as hybrids posted a decline of 11 per cent. In fact, the BEV figures were only 10,000 units less than the hybrids. Remarkably, Tesla’s Model 3 was the number-two overall new vehicle, behind only the Volkswagen Golf.

Sales in the USA totalled about 1 million units, down by 38 per cent from March 2019 – a smaller decrease than both China and Europe.

As COVID-19 didn’t spread to the USA as early as these markets, quarantine only came into force in specific parts of the country during March.

“The USA vehicle market’s growth slowed last year, after many years of strong growth. At the beginning of the year we expected the market to face a slow stagnation, however this is now more likely to decline at a faster pace due to the impact of the global pandemic,” said Munoz.

For China, the landscape has improved since February, when sales shrank by 79 per cent year-on-year.

In March the sales decline was 30 per cent year-on-year. According to the China Association of Automobile Manufacturers, production resumed to 75 per cent of the 2019 yearly average.

The rest of the world posted mixed results. Japan, Korea and CIS countries recorded low decreases, but demand in Latin America fell by 30 per cent to 318,000 units, and India tumbled hard since it’s been in lockdown since mid-March.

Australian car sales tumbled 18 per cent in March, but April is expected to be worse, with smaller order banks to cushion local OEM divisions.