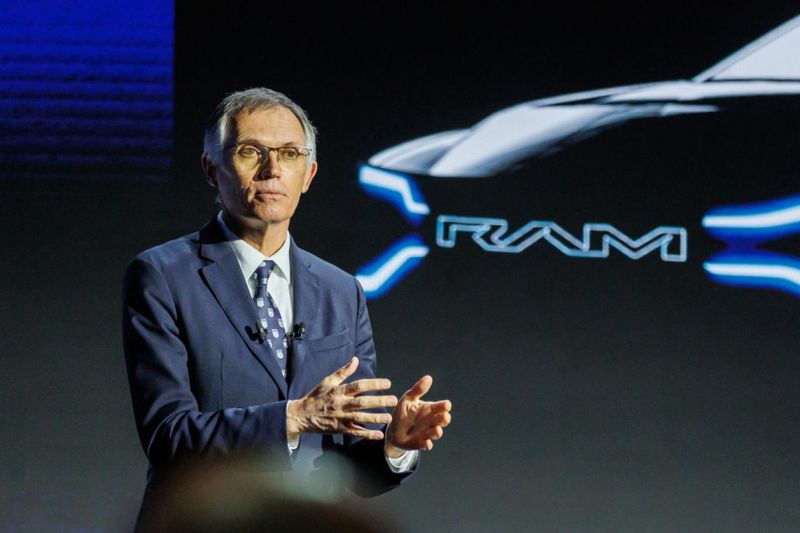

Carlos Tavares unexpectedly resigned early from his role as CEO of Stellantis this week due to having “different views” from the company’s board, and now a new report has shed light on what those views were.

The Financial Times reports the “unanimous” move by the Stellantis board was in part due to differences over the automotive giant’s electrification strategy, according to people it says are familiar with the deliberations.

Two sources told the publication that a “particular point of friction lately” had been Mr Tavares’ push for a more aggressive electric vehicle (EV) strategy to meet tough European Union emissions regulations.

This was reportedly met with opposition from the board, which called for Stellantis – the parent of Jeep and Ram, among other brands – to be more flexible in order to better sustain factory operations and profit margins.

100s of new car deals are available through CarExpert right now. Get the experts on your side and score a great deal. Browse now.

The Stellantis CEO had previously warned the EU against imposing stricter emissions standards, arguing these required carmakers to invest in reducing the emissions of combustion-powered vehicles that were set to be banned on the continent in 2035 anyway.

He had told Welt in February 2024 that he ultimately supported the 2035 EU ban, but called for a pragmatic implementation.

Mr Tavares tendered his resignation on Sunday, December 1, when Stellantis chair John Elkann reportedly spent the day calling senior officials in Rome and Paris to let them know about his decision.

However, it wasn’t just a disagreement over EVs that led to his exit, according to The Financial Times, which said Mr Tavares’ efforts to rehabilitate his reputation in the short term also played a part.

As he had done at Groupe PSA before it was merged with Fiat Chrysler Automobiles to become Stellantis, Mr Tavares had been able to make the conglomerate profitable, and quickly.

Stellantis turned a profit in 2022, its first full year of existence, and then recorded an even greater profit in 2023. But then struggles in the US – where Stellantis had a glut of supply but offered insufficient incentives to shift these vehicles, and had encountered opposition from unions and dealers – led to disappointing numbers.

In September, Stellantis cut its 2024 profit forecast, warning it now expected negative cash flow of between €5 billion and €10 billion (~A$8.1-16.2bn). It had previously expected positive cash flow.

Stellantis’ net profit fell by 48 per cent in the first half of 2024 compared to the first half of 2023, with adjusted operating income dropping by €5.7 billion to €8.5 billion (~A$9.2-13.8bn).

Shortly after the release of this revised forecast, in October, Mr Tavares announced his retirement. He was set to stay on until his term ended early in 2026, until he resigned earlier this week.

The Stellantis boss was reportedly “shocked” by the hit his reputation had taken in recent months.

This year’s disappointing profit forecast came despite Mr Tavares’ cost-cutting measures, some of which raised eyebrows within the company.

That reportedly included reduced IT spending that saw Stellantis lose track of thousands of vehicles in France. He also reportedly looked to “squeeze” suppliers in recent months, but the board felt such short-term measures weren’t sustainable.

Reuters reported that a senior investment banker briefed on the matter said the board was worried Mr Tavares’ cost-cutting measures were leading to quality issues and hindering the company’s ability to develop and design new vehicles.

As to who will replace Mr Tavares, sources told The Financial Times there were “good internal candidates” but the board would also look at potentially hiring externally.

Stellantis confirmed earlier this week the process to appoint a permanent CEO, managed by a Special Committee of the Board, is “well under way” and will be concluded within the first half of 2025.

In the interim, an interim executive committee chaired by John Elkann will man the ship.

It has still yet to offer much of an explanation for Mr Tavares’ departure.

“Stellantis’ success since its creation has been rooted in a perfect alignment between the reference shareholders, the Board and the CEO,” said Stellantis senior independent director Henri de Castries in a release published Sunday.

“However, in recent weeks different views have emerged which have resulted in the Board and the CEO coming to today’s decision.”

Stellantis has already taken steps this year to reduce its inventory in the US, addressing a key pain point for the automotive giant.

It still has to contend with a dispute with the United Auto Workers (UAW) union there over its plans for the mothballed Belvidere Assembly Plant in Illinois.

This was supposed to be brought back online to produce a new pickup truck for Ram from 2027, but Stellantis announced in August that planned investments in the factory have been delayed.

The new CEO will also have to preside over a review of the performance of each of Stellantis’ 14 brands at some point in 2026.

The chairman of Stellantis’ National Dealer Council in the US, Kevin Farrish, accused Mr Tavares in an open letter earlier this year of ignoring warnings over the past two years and that had led to “disaster”.

Mr Farrish accused Mr Tavares of “reckless short-term decision-making”, the consequences of which included “the rapid degradation of our iconic American brands – brands like Jeep, Dodge, Ram and Chrysler”.

MORE: Jeep, Ram parent company CEO quits abruptly amid troubles with key brands