Online car sales are a growing piece of the puzzle for carmakers in Australia.

Dealerships have been prevented from selling to customers due to lockdowns intended to stop the spread of COVID-19, with dealerships in Melbourne only reopening yesterday. Consequently, carmakers have accelerated the development of alternative ways to reach customers.

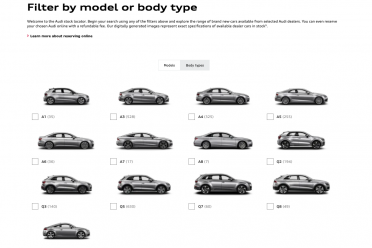

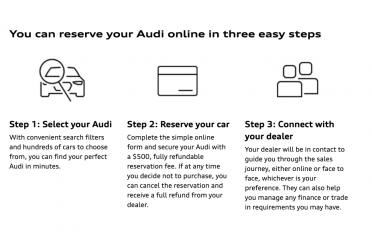

Volkswagen, Audi, Kia, Toyota, Subaru, BMW, and Mini have launched ways for customers to buy cars online during the pandemic in Australia.

Anastasia Lloyd-Wallis, consumer behaviour expert at Retail Doctor Group, told CarExpert the pandemic has accelerated the switch from in-person retail to online sales.

“Pre-COVID, on average nine per cent of Australia retail as a whole was done online,” Ms Lloyd-Wallis said.

“In the last six months we’ve seen a massive accelerant, COVID has really brought it forward. We’re now seeing about an average of 15 per cent.”

Volkswagen Australia says it has sold 460 cars since launching its online sales portal, with a combined value of $36 million. Although that represents just 1.55 per cent of its sales to date in 2020, the average online sale price of $78,260 is significant.

Ms Lloyd-Wallis says Australians are increasingly willing to spend big money online, having graduated from buying groceries and clothes to furniture, luxury goods, and electronics.

Technologies such as augmented reality – which allow potential buyers to view a virtual version of the car they’re considering in their driveway, for example – have also played a role in making buyers comfortable parting with their hard-earned from a distance.

Despite the shift to online sales, she says there’s going to be a role for in-person interaction for a long time yet – although exactly what that looks like might need to change.

“There’s a growing divide between convenience and experiential retail,” she said.

“Effectively, what’s transactional and what’s an experience. I think there’s still a large place for the physical store, and that will never go away because consumers, we’re all social beings. We like to interact, we like to experience products.”

“It’s all about the experience. So it’s much more about how that car fits into your lifestyle, and rather than just having several cars [in a showroom] it’s evoking those emotions, creating this emotional experience in the showroom – because customers are really looking for, when they leave their house, they really want it to be more of an experience,” Ms Lloyd-Wallis later said.

“I think that’s really going to filter through to that car-buying experience. If [customers] making the effort to set foot in the showroom, they want it to be special.”

Talk about showrooms sticking around for the long haul despite the rise of online sales been echoed by a number of carmakers. Volkswagen Australia managing director Michael Bartsch described the brand’s online sales portal as adding “another major tool to the toolbox”.

“It won’t change the business model fundamentally, but there are two or three generations coming through now where online, digital shopping is as natural as what used to be for old people like me going down to the corner shop to buy a Paddlepop,” he said.

Kia Australia chief operating officer Damien Meredith reiterated his brand’s commitment to “that wonderful setup between motor vehicle manufacturers and their franchise dealers”, but said “you’ve got to be up to date with technology and what people require, what makes people feel comfortable with your brand”.