Jack Quick

7.9

6 Days Ago

The Motor Accident Insurance Commission has released a discussion paper on Queensland's Compulsory Third Party insurance scheme.

Contributor

Contributor

Insurance provider RACQ is calling for a level playing field as the Motor Accident Insurance Commission welcomes submissions to a discussion paper into the state’s Compulsory Third Party (CTP) insurance scheme.

The regulatory authority is undertaking the first review of the scheme since 2016 and says it wants to “ensure it continues to deliver ongoing affordability and fairness”.

The review will look into three scenarios: maintaining the status quo; transitioning to a public underwriting model and retaining the existing privately underwritten model with scheme design changes.

Scheme design changes floated by the discussion paper include randomly allocating customers to insurers instead of allowing them to choose, allowing multiple licensing for insurers to increase competition, promoting customer choice and equalising premiums.

The latter is something the RACQ is calling for, with CEO David Carter welcoming the review and claiming CTP premiums are currently unfairly distributed.

RACQ CEO David Carter has welcomed the review, claiming that CTP premiums are currently unfairly distributed.

“As a result of how CTP premiums are collected and distributed across the four insurers in the scheme, an unlevel playing field has been created where some insurers are receiving greater profits despite carrying less risk,” said Mr Carter.

“RACQ has been in discussions with the State Government, calling for a level playing field in the scheme, and we welcome the consultation paper’s inclusion of an option for premium equalisation.

“A change like this would not impact motorists or how much you pay for CTP, nor would it impact any other professionals, including legal and health practitioners, who work in the scheme.”

RACQ is recommending premium equalisation for all four CTP providers in Queensland: RACQ, QBE, Suncorp and Allianz.

The discussion paper suggests there are opportunities for improvement in price competition and insurer profitability.

Final submissions for the review will close on April 21.

CTP premiums are collected via Queensland residents’ vehicle registration fees.

The Commission’s review promises to not change the CTP Scheme premium setting process or compensation benefits for injured people but will instead focus on “identifying opportunities to improve the scheme’s sustainability”, says Cameron Dick, Treasurer and Minister for Trade and Investment.

Mr Dick claims Queensland has the lowest CTP premiums in mainland Australia and delivers compensation to support people injured in road crashes through no fault of their own.

“Queensland has the most affordable CTP scheme in Australia, and it’s important the government keeps it that way, by undertaking periodic reviews,” said Mr Dick.

“CTP is clearly delivering for Queensland drivers but for its long-term health we need to make sure it is sustainable for insurers as well.

“We’re looking to here from any industry participants or other stakeholder with ideas about how things can be done better.”

The CTP scheme in Queensland currently provides compensation benefits for 4.68 million registered vehicle owners within the state.

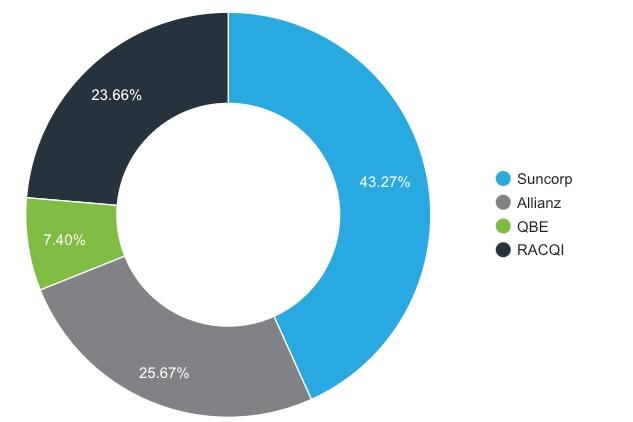

According to the Motor Accident Insurance Commission, RACQ had 23.66 per cent of overall insurer market share during 2020-21.

Suncorp had a larger 43.27 per cent share, followed by Allianz with 25.67 per cent. QBE was the smallest player with 7.40 per cent.

Jade Credentino is an automotive journalist currently based in Melbourne, Australia. Jade has had a chance to review a variety of vehicles and particularly enjoys SUVs. She enjoys traveling and going on road trips exploring Australia.

Jack Quick

7.9

6 Days Ago

Neil Briscoe

5 Days Ago

William Stopford

8.5

4 Days Ago

James Wong

7.9

3 Days Ago

Jack Quick

8.4

2 Days Ago

Matt Campbell

8.1

1 Day Ago