James Wong

5 Days Ago

News Editor

GroupeRenault has outlined its product plans for its namesake brand as it aims to get back in the black.

The plans include an increased focus on the C-segment (small cars and mid-sized SUVs) and a slightly more premium push, aimed at giving popular Dacia some breathing room.

The company has committed to the Megane despite flagging sales in its fourth generation, and has indicated it wants a crossover to join the Megane family.

Additionally, Renault is continuing its rollout of the Arkana coupe crossover to more markets including Western Europe and Australia this year.

Last year’s Megane eVision all-electric concept will also presage a production EV within Renault’s C-segment family. It’ll be introduced later this year as a rival for the Volkswagen ID.3 hatchback.

Renault’s current offerings in the C- and C-SUV segments are approaching the end of their lifecycles. The Kadjar is the oldest, introduced in 2015, Megane and Koleos were launched in 2016.

In Australia at least, the Kadjar is getting axed entirely. It’ll be replaced here by the Arkana.

In total, Renault wants 45 per cent of its European market passenger car sales to be in the C- and D-segments by 2025.

Three quarters of Renault’s overall profit currently comes from sales in the European market, so Renault is aiming to maximise its profitability there.

Last year, C/D segment models accounted for 15 per cent of the Renault Group’s contribution margin. It wants to increase this to 40 per cent by 2025.

Though Renault wants to rely less heavily on the B-segment (light cars), it still has fresh product lined up and wants to defend its position there.

Most notable is the upcoming, all-electric Renault 5 that was revealed this week. It’s expected to be joined by another retro EV hatchback paying homage to famous Renaults, with the 4 nameplate expected to be dusted off.

Renault also has three new international B-segment models it’ll roll out over the next two years, though we don’t yet know what they’ll be.

In its presentation, the company distinguished these from “Core” Renault products which suggests these are region-specific models, something the company will now move away from.

Notably, the two upcoming “Core” B-segment models will feature battery-electric power.

The company has committed to the D-segment despite rumours it would discontinue its flagship, mid-sized Talisman sedan and wagon.

It’s indicated new D-segment models will arrive in 2023 and 2024, though it’s possible these could be SUVs and the Talisman will still be taken to the crypt.

Additionally, Renault has six new light commercial vehicles launching between now and 2025. Three of these will offer battery-electric power.

Renault currently offers all-electric Z.E. versions of its Kangoo and Master vans.

No replacement for the quirky, rear-engined, rear-wheel drive Twingo, based on the Smart Fortwo and Forfour, appears in the plan as the A-segment row is empty.

The current car was introduced back in 2014, though Renault revealed an all-electric Z.E. model last year.

Also potentially facing the axe are the Scenic and Espace MPVs.

Though Megane sales have declined much like those of Renault’s MPV range, CEO Luca de Meo has committed to the segment and has been candid about Renault’s disappointing performance in the C-segment.

He’s hoping to recreate the same success Renault enjoyed with its first-generation Megane range and related Scenic, an example of Renault’s halcyon days in the C-segment. The Scenic was a smash-hit in Europe and essentially created the compact MPV segment.

There’s one other C-segment Renault coming in 2025, which Renault has labelled a Renault International product.

That could indicate a new product for Renault-Samsung Motors, which currently builds and sells the Talisman sedan and Koleos and Arkana SUVs under the Samsung brand for the Korean market.

Though Dacia has exploded in popularity in Europe, in many markets its products – including important markets for Renault like Brazil and Russia – its products are sold under the Renault brand.

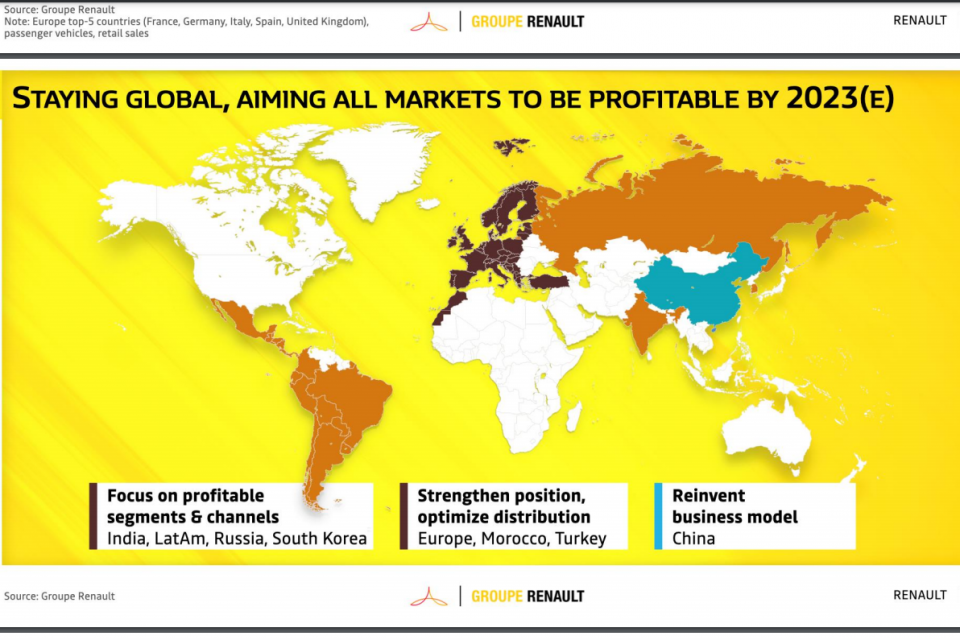

Renault is scaling back its goals for world domination, and has highlighted Brazil, India, Latin America and Russia as markets where it wants to focus on profitable segments and channels.

It’s also aiming to strengthen its position in Europe, Morocco and Turkey, where it does well, and completely reinvent the way it does business in China, where it doesn’t.

Last year, it dissolved its joint-venture with Dongfeng and withdrew the Renault brand from China entirely.

During 2020, Renault also pulled the plug on seven vehicle programs that were in the pipeline.

In the short term, Renault will look to be more efficient with its model range globally.

The brand’s global range is currently made up of 40 per cent region-specific models, which are more expensive to develop because they require unique parts and supply chains.

For example, the Russian-market Arkana uses a completely different platform from the model sold elsewhere.

Renault will also reduce the number of platform it uses, with 80 per cent of the Group’s volumes to be reduced from six to just three shared Renault-Nissan-Mitsubishi Alliance platforms by 2023.

These are the CMF-B platform, which also supports electric vehicles, as well as the larger CMF-C/D platform and the dedicated electric CMF-EV platform.

Combined with hybrid power, Renault plans to use just one petrol engine family across its entire range. It will also have one diesel engine family, alongside hydrogen and pure-electric powertrains.

You can read more about Renault’s strategic plan here.

Take advantage of Australia's BIGGEST new car website to find a great deal on a Renault.

William Stopford is an automotive journalist based in Brisbane, Australia. William is a Business/Journalism graduate from the Queensland University of Technology who loves to travel, briefly lived in the US, and has a particular interest in the American car industry.

James Wong

5 Days Ago

Alborz Fallah

4 Days Ago

Andrew Maclean

3 Days Ago

Max Davies

3 Days Ago

Matt Campbell

2 Days Ago

Max Davies

19 Hours Ago