Andrew Maclean

4 Days Ago

Stellantis will offer electric vehicles across all 14 brands, using four new platforms and three different battery types.

News Editor

News Editor

Stellantis is rolling out electric vehicles across four platforms and all 14 of its brands.

The world’s fourth-largest automaker, a merger of the former Fiat Chrysler Automobiles and Groupe PSA, is investing more than €30 billion (A$47.82 billion) through 2025 in electric vehicles.

It’s expecting 70 per cent of its European sales to be “low emission vehicles” (all-electric or hybrid vehicles) by 2030, as well as over 40 per cent of its US sales.

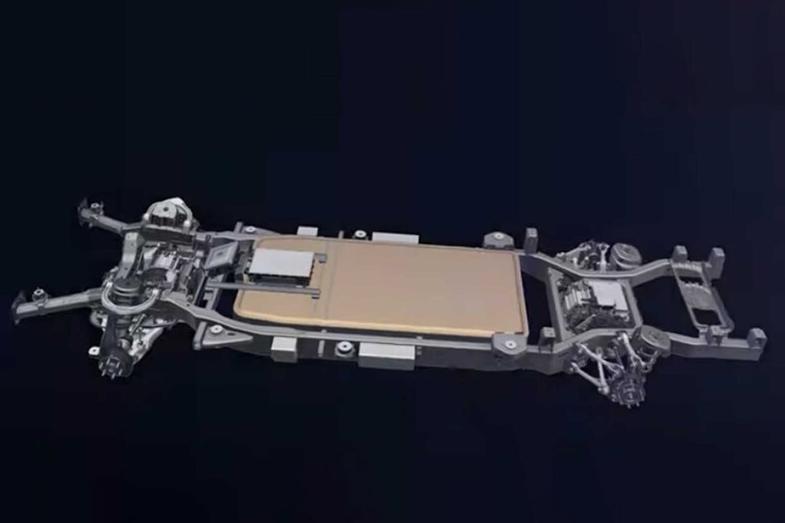

Its fleet of electric vehicles will use four different EV platforms:

Stellantis says it can produce up to two million vehicles per year on each platform, and each platform will be highly flexible in terms of length and width and will support fast-charging of up to 32km per minute.

The company will offer a family of three electric drive modules that combine the motor, gearbox and inverter, and which can be scheduled for front- wheel drive, rear-wheel drive, all-wheel drive, and ‘4xe’.

Stellantis says it will extend the life of these platforms well into the next decade through hardware upgrades and over-the-air software updates, and will develop software and controls in-house “to maintain the characteristics unique to each brand”.

It’ll offer two different battery chemistries: a high energy-density option, and a nickel cobalt-free alternative by 2024.

Solid-state batteries will follow in 2026.

The automaker giant is also rolling out hydrogen fuel-cell medium vans by the end of 2021.

Dodge has already announced it’ll introduce its first all-electric muscle car in 2024, while an electric Ram 1500 will launch the same year with 800km of range.

The Ram brand will also introduce a Ford Ranger-sized electric pickup truck in 2026.

Opel/Vauxhall will sell only electric vehicles in the European market by 2028.

By 2026, it’s aiming to make the total cost of owning an EV equal to that of an internal-combustion vehicle.

Despite this ambitious undertaking, Stellantis is targeting sustainable, double-digit adjusted operating income margins up to 2026.

The company says its financial outlook is aided by the more than €5 billion in synergies as a result of the merger.

It also expects to be 30 per cent more efficient than the industry with its capital expenditure and research and development spend versus its revenues.

It’s looking to secure more than 130GWh of capacity by 2025 and more than 260GWh by 2030, necessitating five “gigafactories” across Europe and North America.

The company says it’s also signed memorandums of understanding with two lithium geothermal brine process partners in North America and Europe to secure a sustainable supply of lithium.

It hopes to reduce battery pack costs by more than 40 per cent from 2020 to 2024, and by an additional 20 per cent or more by 2030. To do so, it’s looking at simplifying the modules, increasing cell sizes, and upgrading the chemistry.

It’ll also develop a comprehensive, sustainable system for repairing, remanufacturing and reusing old batteries and will support the develop of fast-charging networks across Europe.

“We have the scale, the skills, the spirit and the sustainability to achieve double-digit Adjusted Operating Income margins, lead the industry with benchmark efficiencies and deliver electrified vehicles that ignite passion,” said Stellantis CEO Carlos Tavares.

The Stellantis empire comprises 14 brands: Abarth, Alfa Romeo, Chrysler, Dodge, DS, Fiat, Fiat Professional, Jeep, Lancia, Maserati, Opel/Vauxhall, Peugeot and Ram.

It currently offers all-electric vehicles across only the DS, Fiat, Fiat Professional, Opel/Vauxhall and Peugeot brands.

William Stopford is an automotive journalist based in Brisbane, Australia. William is a Business/Journalism graduate from the Queensland University of Technology who loves to travel, briefly lived in the US, and has a particular interest in the American car industry.

Andrew Maclean

4 Days Ago

Max Davies

4 Days Ago

Matt Campbell

3 Days Ago

Max Davies

2 Days Ago

Josh Nevett

17 Hours Ago

Damion Smy

13 Hours Ago