Josh Nevett

7.3

3 Days Ago

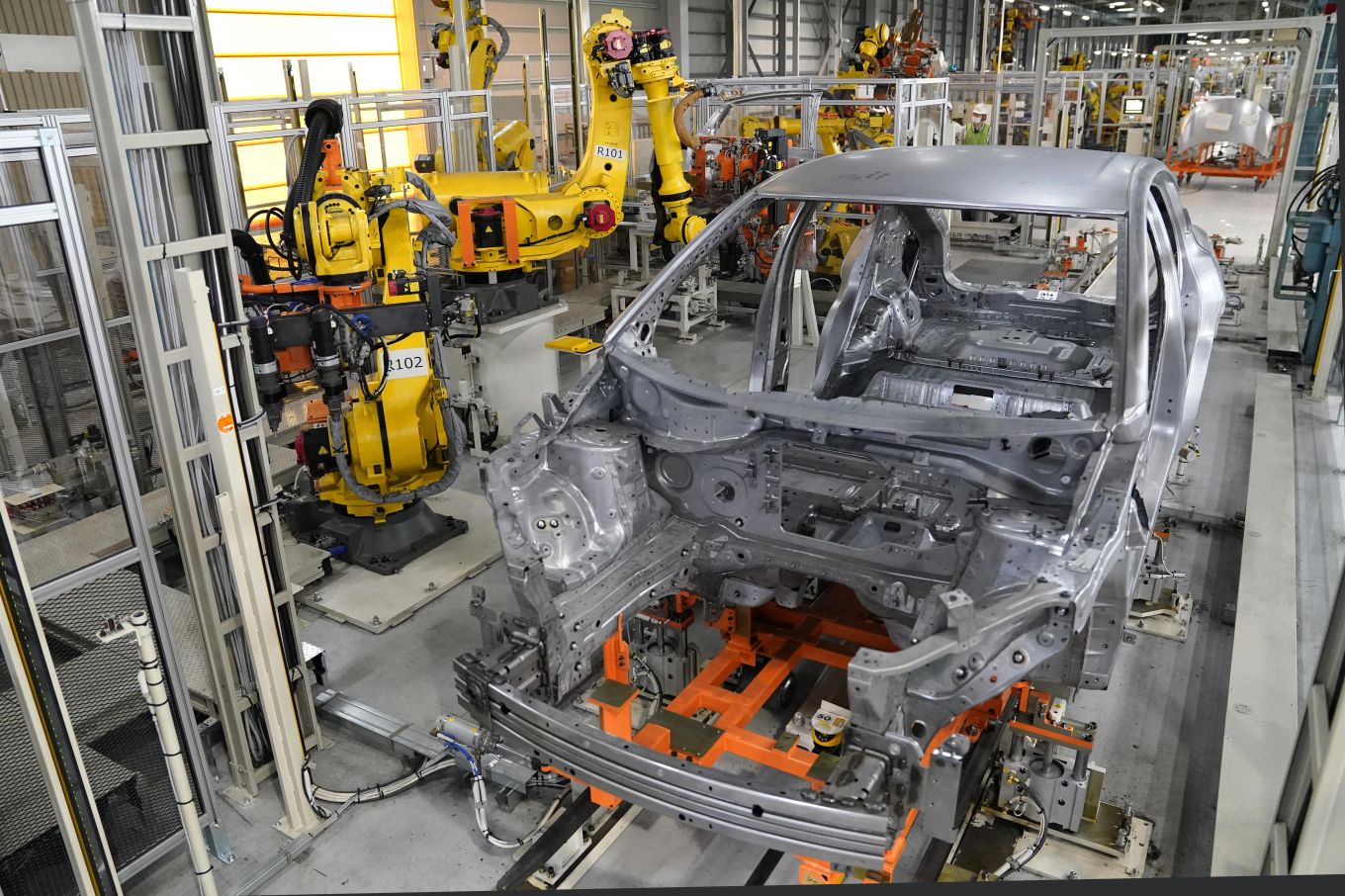

Major manufacturers have reported reduced production and delivery numbers, and the spectre of a stock squeeze remains present.

The semiconductor crunch has hit hard, with major manufacturers reporting nearly unanimous hits to production and deliveries – despite generally strong levels of demand.

Production reports published by the global parents of Australia’s top-selling car brands paint a pretty bleak picture. The situation suggests current low stock levels could remain a factor.

Manufacturer global HQs are, however, shoring up profits thanks to demand for higher-margin cars, be they premium vehicles or light commercials and pickups. That’s needed to fund expensive electric car research and development.

Toyota said its worldwide production declined 39.1 per cent in September, attributed both to the chip crunch and COVID outbreaks in key Asian plants. TMC’s output is actually up 15.6 per cent year-to-date, meaning September’s output really did hit the wall.

Toyota Australia management has apologised to customers for the long wait lists hitting some of its cars. The company has, however, repeatedly expressed confidence that better supply will start hitting showrooms during 2022 and nothing has changed on this front.

Mazda’s worldwide production declined 44.1 per cent in September. Exports to Oceania fell 74.4 per cent, but it remains to be seen how this will translate to Mazda Australia sales – it might have stock of certain cars as a buffer.

Ford reported a 14 per cent decline in its wholesales over Q3. However it also said the situation was improving relative to Q2. “Semiconductor availability remains a challenge, but markedly improved from the second quarter” it added.

MORE: Staggering impact of semiconductor shortage on car industry revealed

Interestingly Automotive News reports Ford started the quarter with 60,000 to 70,000 unfinished vehicles awaiting chips and related components but ended the quarter with 27,000.

Hyundai reported a 9.9 per cent sales decrease (rather than production) around the globe in the July to September period, attributed to “disruption of the chip supply around the globe”.

At the same time its revenue rose, because it focused on higher-margin products. “Sales of EVs and Genesis luxury brand models drove the momentum in revenue. In addition, the effect of an enhanced product mix grew profitability in the third quarter,” it said.

Hyundai has said it wants to start developing its own chips in-house and reducing its reliance on third-party suppliers. As reported by Reuters these chips are going to be developed and manufactured by Hyundai Motor Group supplier, Hyundai Mobis.

Kia Corporation recorded a 14.1 per cent decrease in total global wholesales for September year over year. It said the decrease “mainly resulted from the market disruption caused by the semiconductor supply shortage around the globe”. Familiar story that.

“Kia will continue to focus on maintaining positive sales momentum and enhancing profitability through new models, such as the EV6 battery electric vehicle and all-new Sportage SUV,” it added.

Volkswagen Group’s vehicle output plunged 35.1 per cent over the third quarter due to the chip “bottlenecks”, according to its business report, and its volume brands (Volkswagen, Skoda) posted operating losses despite “full order books”.

But because it like many others focused on output of higher-margin cars from the premium brands, operating profits weren’t so severely affected. It also sold a record haul of electric cars (122,100, up 109 per cent YoY) and tipped more into R&D over the quarter too.

Nissan reported global production in September declined 27.9 per cent from the year before. That’s in the context of a yearly production increase of 3.0 per cent.

Subaru said September production output was down 68.1 per cent, in the milder context of a 14 per cent production decline year-to-date. “Overseas production decreased as a result of production adjustments caused by the global shortage of semiconductor supplies,” it added.

According to Honda’s release, its total worldwide production experienced a year-on-year decrease for the fourth consecutive month in September.

Daimler’s sales dropped 25 per cent and in production terms added “the world-wide supply shortage of certain semiconductor components affected global deliveries to customers in Q3, especially in the month of September”.

It wasn’t all doom and gloom. Mitsubishi Motors bucked the trend and increased output by 26.1 per cent in September, while production in Thailand (where Triton and Pajero Sport are made) spiked 144.9 per cent.

In other potentially welcome news, Robert Bosch (the world’s largest auto supplier) said it will invest more than $600 million in its semiconductor manufacturing facilities in 2022.

Josh Nevett

7.3

3 Days Ago

James Wong

2 Days Ago

Andrew Maclean

2 Days Ago

Josh Nevett

8

2 Days Ago

Jack Quick

7.9

1 Day Ago

CarExpert.com.au

14 Hours Ago