Jack Quick

7.9

6 Days Ago

Tesla or Toyota, which do you think has depreciated more?

Founder

Founder

Resale value is an important consideration for new-car buyers. But what happens if you’re buying a car that has never been offered in the market before?

That’s what happened to me. With little understanding of how resale value would go when I bought a 2019 A90 Toyota Supra GTS and a 2019 Tesla Model 3 Performance, one year on from owning both cars I wanted to see how they shaped up – and I’ve come away surprised, but not in a good way.

Resale value is a part of the new-car buying process most people don’t want to talk or think about – but the expensive thing you’re buying will be worth considerably less in a couple of years time, it’s the reality of the situation. There are a handful of cars that may appreciate in value due to rarity, of course, but that’s the exception to the rule.

You can also get a better picture of resale if a model has been on the market for a while, or if it has a history of high resale value. A great example of this is the Toyota LandCruiser 70 Series.

Toyota has made incremental improvements over time, but if you spend $65,000 on one today it’s likely you’ll recover most of that cost if you sell it in five years time.

Spend a bucketload of cash on a McLaren or a Rolls-Royce though, and the opposite is likely to happen. You’ll end up losing a more money the longer you keep the car, which is partly because the first buyer absorbed all the one-off taxes and fees associated with buying a new car.

So what happened in my case? Here’s the full break down of the prices I paid, along with all the extra fees involved:

| 2019 A90 Toyota Supra GTS | 2019 Tesla Model 3 Performance | |

|---|---|---|

| Base price | $80,613.15 | $77,272.72 |

| Options | Alcantara interior ($2500) matte grey paint ($2500) | Performance upgrade ($5636.36), white interior ($1272.73) |

| Additional fees | Registration ($302.40), CTP ($532.40), VicRoads online fee ($45.50), personalised plate transfer fee ($128.40) | Delivery fee ($795.45), registration ($238), CTP ($532), personalised plate transfer fee ($128) |

| Stamp duty | $7154 | $4158 |

| GST | $8561.32 | $8497.74 |

| Luxury Car Tax | $7994.84 | $5384 |

| Total (on-road) | $110,332.01 | $103,915 |

At this point it’s worth calling out that the Toyota Supra was initially limited to around 350 vehicles in the first 12 month allocation. It’s unclear whether that figures includes a batch of dealer demonstrator vehicles dealers couldn’t sell for six months after delivery.

Tesla doesn’t share sales figures, but based on our previous digging on Tesla Model 3 sales between 2500 and 3000 examples have been sold and delivered in Australia.

Both Toyota and Tesla run certified used vehicle programs where they sell cars inspected in-house before being listed online. I used that source, plus used listings on CarSales, to see how both cars depreciated over the period of less than a year.

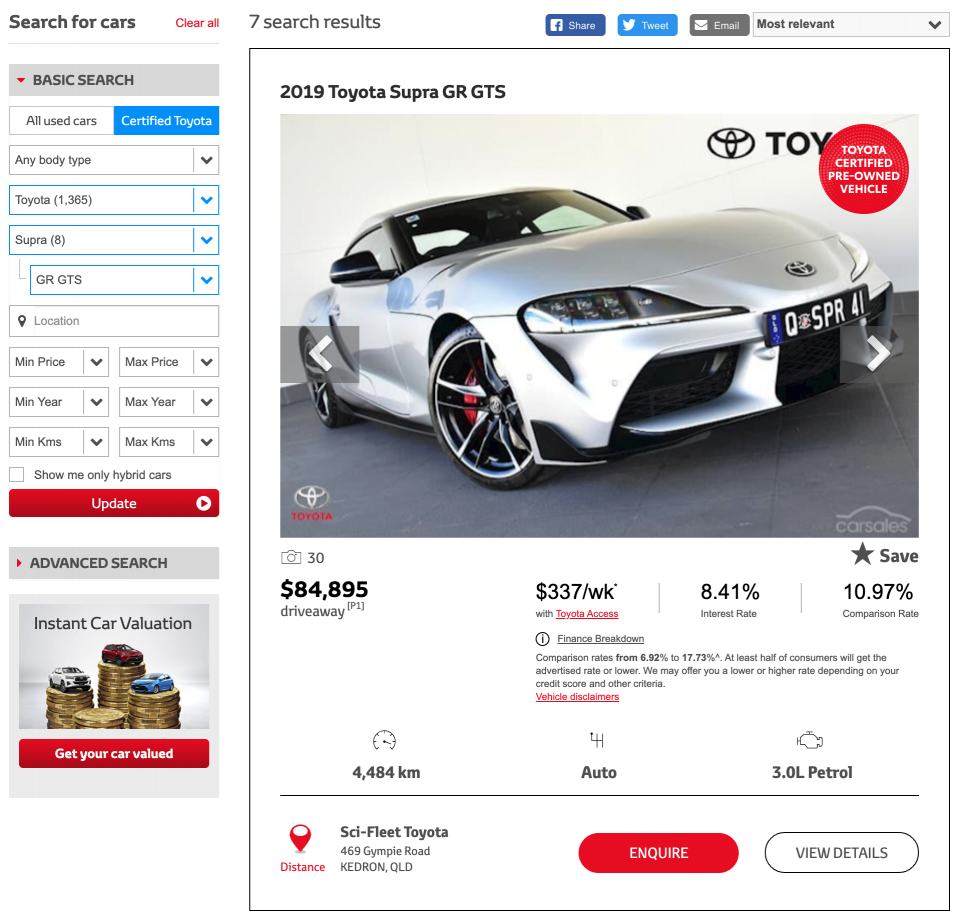

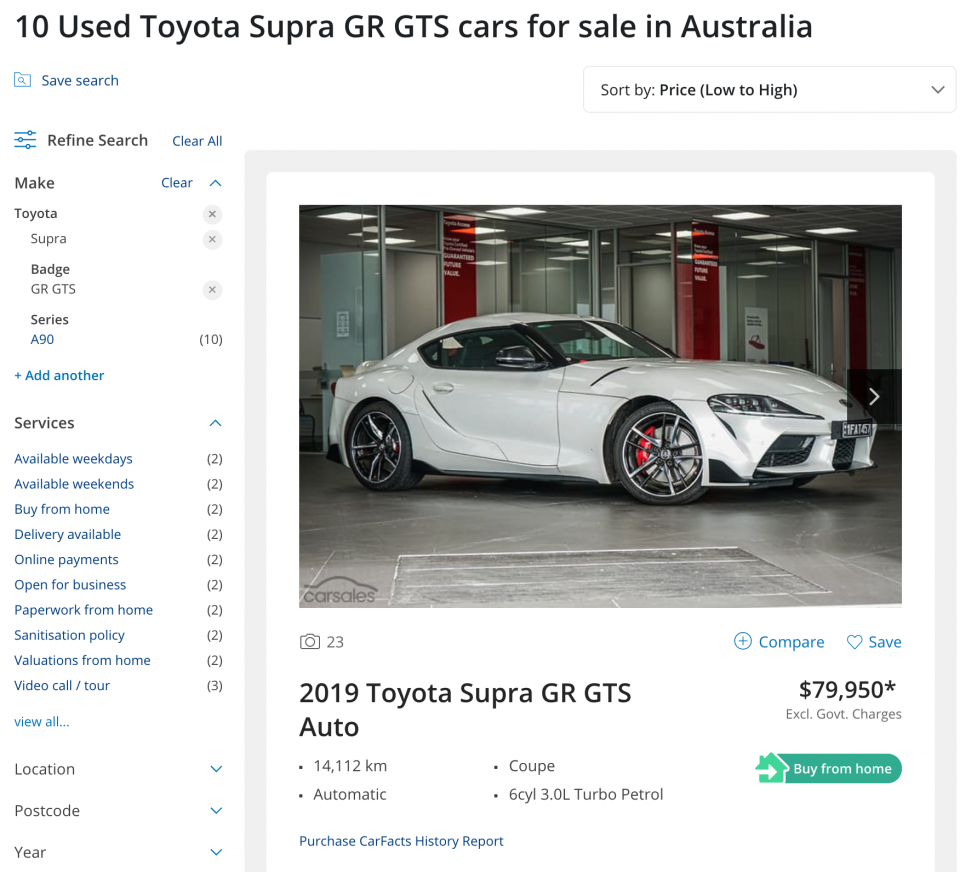

Toyota’s certified used program has eight vehicles available for sale. Of the eight, seven are the top-specification GTS trim and there are a mix of vehicles fitted with the optional Alcantara or red interior trim ($2500), but none are finished with matte paint ($2500).

They range in mileage from 2213km through to 14,112km. They range in price from $84,048 drive away, through to $91,490 drive away.

Hit the wider market and there are 64 Supra GTS vehicles available for sale (44 demos or brand new, 10 are used). The used cars range from $82,777 drive-away (white with 3500km, and the $2500 Alcantara seats), all the way to $116,800 before on-road costs for a matte grey car with 26km, and the same options fitted to my car.

The average price of all the certified used vehicles is $87,212 (drive-away) and the average price of all used vehicles on CarSales is $93,888 (drive-away). That’s depreciation of 20.9 per cent and 14.9 per cent respectively.

There’s a slight variance in there because some vehicles listed as certified and some listed as uncertified don’t perfectly match my Supra’s specification – some have no options, others only have one of the two $2500 options fitted to mine, which when added would affect depreciation values slightly.

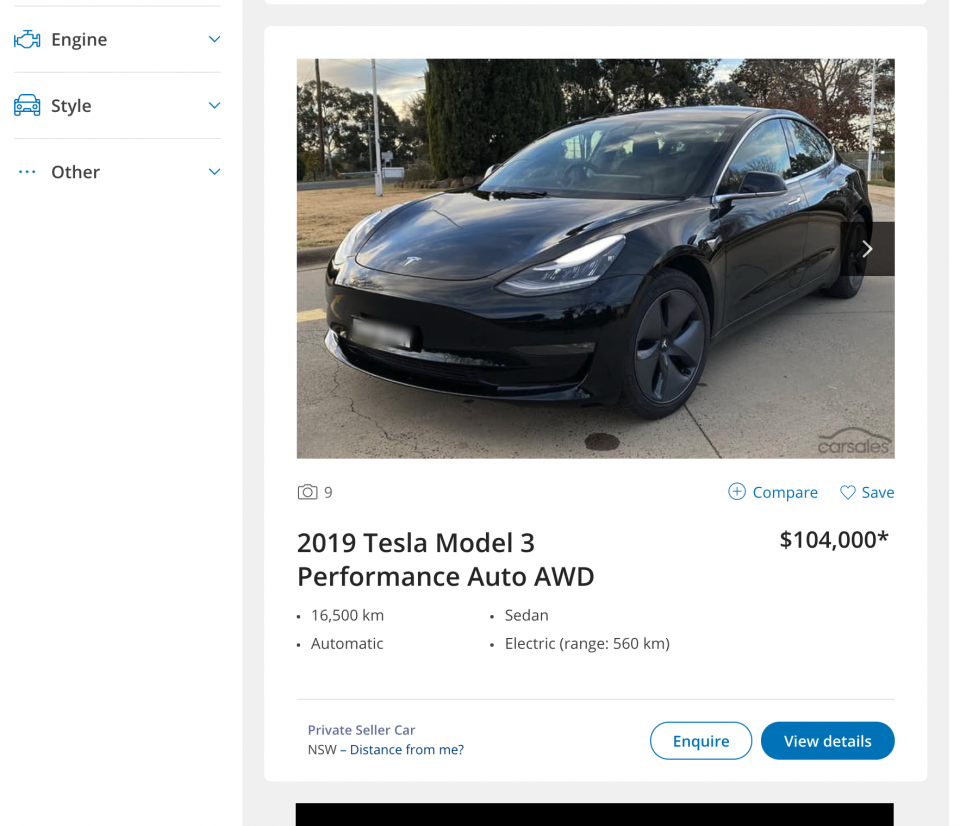

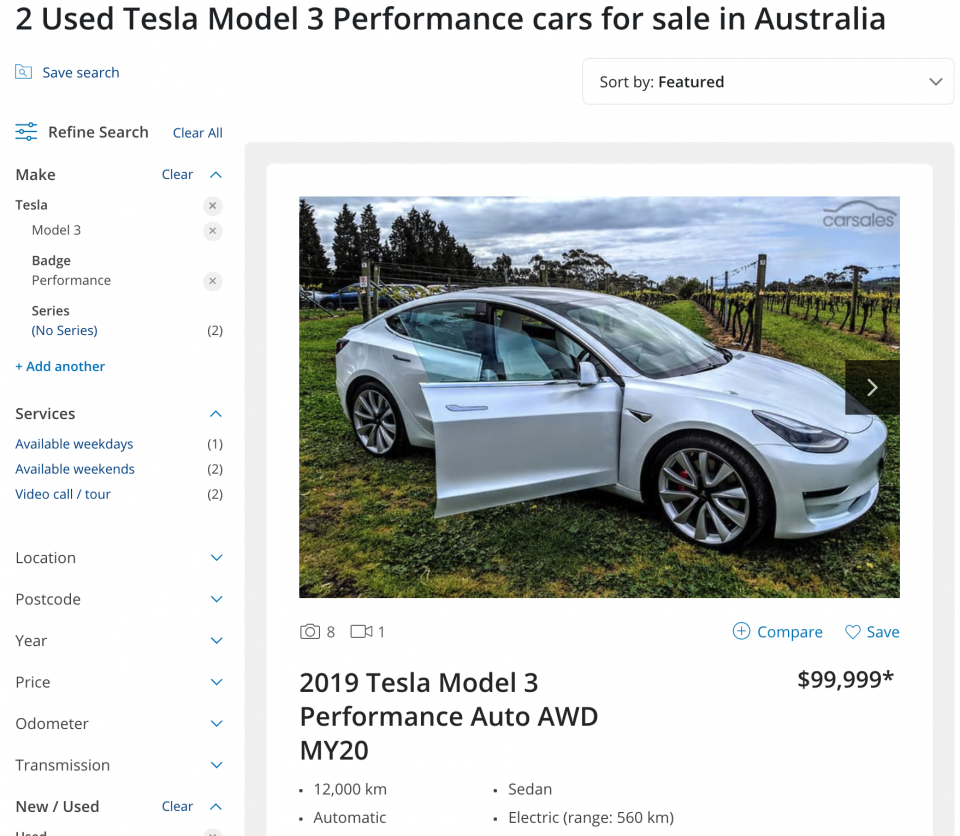

Tesla’s certified used program had one vehicle available for sale (it has since been sold), which was a silver Model 3 Performance – without the $6200 performance upgrade or $1400 white seats, and with 7888km on the clock – and was listed for $88,300 before on-road costs, which would total $5000.

On the wider market are two used vehicles. One is a Model 3 Performance without the $6200 performance upgrade, or the $1400 white seat upgrade, and is listed for $104,000 before on-road costs with 16,500km on the clock.

The other matches my specification, which is a white Model 3 Performance with the $6200 performance upgrade and the $1400 white seat upgrade is priced at $99,999 before on-road costs, with 12,000km on the clock.

The average price of the certified used vehicle is $93,405 drive-away and the average price of the used vehicle on CarSales is $106,285.50 drive away. That’s a depreciation of 10.1 per cent and an appreciation of 2.2 per cent respectively.

If you were to add the value of the performance upgrade and the white seats to the certified used car to match the specification of the car I bought, it would adjust the depreciation outcome slightly.

It’s interesting to compare how two brand-new cars, both to me and the Australian market, depreciated over the same period of time.

I was surprised to see how steeply the value of the Supra has declined given it was far more limited than the Tesla, but also I was pleasantly surprised to see how well the Tesla has held its value.

| 2019 A90 Toyota Supra GTS | 2019 Tesla Model 3 Performance | |

|---|---|---|

| New purchase price* | $110,332.01 | $103,915 |

| Average certified used price* | $87,212 | $93,405 |

| Average private used price* | $93,888 | $106,285.50 |

| Depreciation certified used* | –20.9% | –10.1% |

| Depreciation private used* | –14.9% | +2.2% |

One of the things Toyota has going against it at the moment is what appears to be a big number of people buying the original batch of Supras with the sole intent of reselling them, something often happens with highly sought-after new models.

Then COVID hit, and some of the people planning to wait for the right price have been strapped for cash and looking for a quick sale, which ultimately drives down the model’s value on the used market.

Toyota has also, in my opinion, made a mistake by annually upgrading more power and different hardware. This is likely dissuades people from buying a new model, because it’s likely to be superseded within 12 months.

This will have an effect on resale for Supras moving forward, and will make them less enticing as a new vehicle purchase.

On the flip side, I believe the opposite is happening with the Model 3. Because software upgrades are constantly rolled out with new features, more range, and more power, there’s less reason to sell the car. It’s always current, and will be current until a major hardware change happens.

The results above are by no means representative of what depreciation values will be like on all electric cars, on all Teslas, or even all Toyotas.

But it’s food for thought. Do you think that the business model of constant small model year changes will continue, or will manufacturers adopt an approach like Tesla’s where the vehicle is a baseline, and extra features can be added over time?

And let us know in the comments below how your new car fared when it came time to sell it. Have you owned any models or bands in particular that have done well over time? Let us know the secret sauce to limiting depreciation on a new car purchase!

Paul Maric is an Australian car expert based in Melbourne, Australia. Paul is a founder of CarExpert.com.au & formerly part of the CarAdvice founding team.

Jack Quick

7.9

6 Days Ago

Neil Briscoe

5 Days Ago

William Stopford

8.5

4 Days Ago

James Wong

7.9

3 Days Ago

Jack Quick

8.4

2 Days Ago

Matt Campbell

8.1

1 Day Ago