Damion Smy

Suzuki Fronx recalled after seatbelt failure sparks ‘urgent investigation’

6 Hours Ago

The automotive landscape in Australia has changed a lot in the last few decades.

From the dominance of locally manufactured models to the influx of foreign cars, those who don’t embrace change are often the ones left behind.

In the 1960s and ’70s, Japanese automotive brands were up-and-coming with cheaper and more efficient alternatives to the Australian, British, and American cars of the day.

While local manufacturers never really took them seriously (until it was too late), over a few decades the cars from Japan (and their Thai-built cousins) became the dominant force in the Australian new car landscape.

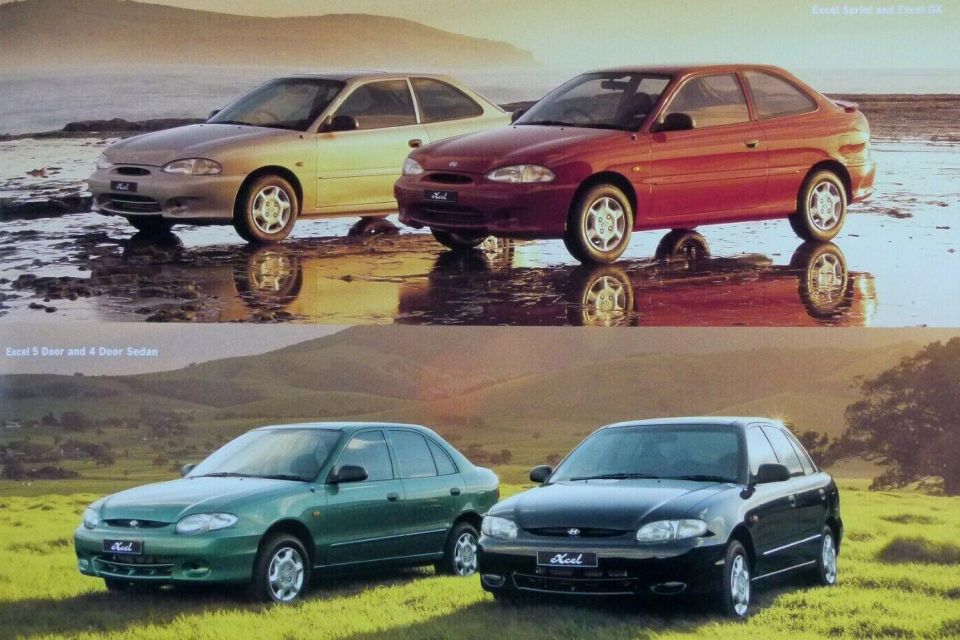

Fast forward to the late 1990s and early 2000s and the South Koreans started their attack on our market, with ambitious plans to take market share away from the Japanese. Using their own strategy against them, Korean brands came with cheaper cars that offered more. This offered Australians more choice and better competition.

By now, a pretty clear pattern had emerged. Australia had become a testing ground for manufacturers that wanted to come and understand western tastes in a market that is relatively easy to enter across our capital cities.

More brands would enter the Australian market before heading to Europe and North America.

Following the Japanese and Koreans, the next nation to enter our car market in the 2010s on a mass scale was China.

The seemingly never-ending barrage of new Chinese brands and models has had a monumental impact on the Australian automotive landscape. Chinese brands have made cars cheaper and safer, and brought affordable electric cars. So what’s next?

History has a funny way of repeating itself, and what Japanese brands did to local manufacturers, the Korean brands did to the Japanese in less time. Now, Chinese brands are doing it to the lot of them in an even shorter period.

Looking further ahead, the country that seems to be showing all the right signs for being the ‘next big thing’ is India.

While the economy in China is showing some signs of distress, India not only recently overtook China as the world’s most populous country, but has also become a much cheaper place for manufacturing.

We also can’t discount the fact it’s a right-hand drive market with much cheaper shipping lines to Australia than most of the world.

In 2023, India was the third largest automotive market in the world by sales.

While many of those vehicles were smaller than what we see in Australia, the Indian market’s annual volume of around 4.2 million vehicles beat out Japan (around 4.0 million), but is still well behind China (25 million plus) and the USA (15 million plus).

Unlike the other top three markets globally which are relatively mature in nature, only around 9.0 per cent of Indians own a car – so opportunity in that market is still substantial. It’s rapidly transitioning to an SUV market like Australia, while utes (a market in which Mahindra has more than 50 per cent share) are popular.

As with any brand that aspires to be a global player, stretching outside their home market and going west is a sure sign of success and Australia is currently home to over 60 brands.

Although Tata has been selling the Xenon in Australia for some time, it remains largely unwilling to expand and bring in additional products.

A brand that has been making steady progress here with well-priced cars and an ever-expanding dealer network is Mahindra.

With the Scorpio and XUV 700 SUVs as well as the S11 Ute, the Indian brand has been going about its business of grabbing market share and building its brand in Australia.

It also has a much longer history than many give it credit for, with automotive experience dating back to 1945.

The question remains, will Mahindra be the next MG or BYD?

While Chinese brands have focused on electrification, Indian brands have continued refining internal combustion engine offerings with better value, warranty, and specifications which appear to be resonating well with middle Australia.

Although the brand does not officially list its sales data, sources have confirmed the brand has seen significant growth in the last few years with new models and a deeper push into the metro areas, now with 69 dealers around the country.

Mahindra bought Italian automotive design firm Pininfarina in 2015 and the latest products coming have all enjoyed the European design house’s influence; the same design house that penned the Ferrari F12 and LaFerrari.

Much like the Chinese government, which is heavily subsidising its manufacturers to capture market share overseas, the Indian government is beginning to invest in promoting sustainable and innovative automotive technologies.

It’s not just cars though, global brands like Apple also manufacture high-end technology products in India.

With the impact of international politics on China, Apple is investing billions to see its global production volume shift toward India. The market is expected to account for almost a quarter of all global iPhone production by 2028 (currently, China makes up more than 90 per cent).

While some could argue Chinese brands may have jumped the gun in overestimating the EV adoption rates in the Western world, the Indians may not be playing the type of catchup many think when it comes to EVs.

Perhaps India will outpace China in automotive software. Given the country’s strong foundations in software development and the reality electric vehicles are ultimately giant batteries attached to a moving computer, the potential for the South Asian country to become a dominant force in the segment remains high.

No matter how you look at it, the world most populous country can now offer cheaper labour than China and has not gone all-in when it comes to electrification, which may suit the Australian market for the near- and medium-term future.

India’s automotive industry continues to grow and make significant investments in creating vehicles for western markets.

What remains to be seen is if the next-generation of products from brands like Mahindra will have the capacity to go mainstream in markets like Australia.

I'm an Indian-born automotive enthusiast living in the US, with a huge passion for cars. I have a natural storytelling ability and love captivating writing that brings stories to life. I've been writing about cars for over 10 years. My passion is expertly navigating the dynamic world of cars, delivering engaging content for car aficionados.

Damion Smy

6 Hours Ago

Damion Smy

7 Hours Ago

Damion Smy

9 Hours Ago

Damion Smy

11 Hours Ago

CarExpert.com.au

13 Hours Ago

Ben Zachariah

14 Hours Ago