Australian electric vehicle (EV) charging equipment manufacturer Tritium, which had pivoted to the US market, has declared itself insolvent.

Troubled Tritium, in a filing on April 18, 2024 with the US Securities and Exchange Commission (SEC), has called for an administrator to be appointed.

“On April 18, 2024, by resolutions of their boards, it was determined that the Company and three of its Australian subsidiaries, Tritium Pty Ltd, Tritium Holdings Pty Ltd and Tritium Nominee Pty Ltd… were insolvent or likely to become insolvent,” the filing reads.

In the filing, it says Peter Gothard, James Dampney, and William Colwell of KPMG should be appointed as joint and several administrators of the Nasdaq-listed firm.

They’ll take control of the companies subject to their appointment.

The Australian reports McGrathNicol’s restructuring team has been named receivers and managers of Tritium, with Shaun Fraser telling the publication the team’s immediate focus was to stabilise the company’s operations and work closely with its employees, customers and suppliers “to secure the best possible outcome for all parties”.

“A sale process for Tritium’s business and assets was underway prior to our appointment and we will be re-engaging as a matter of urgency with interested parties and the broader market to seek to find long-term capital,” Mr Fraser said.

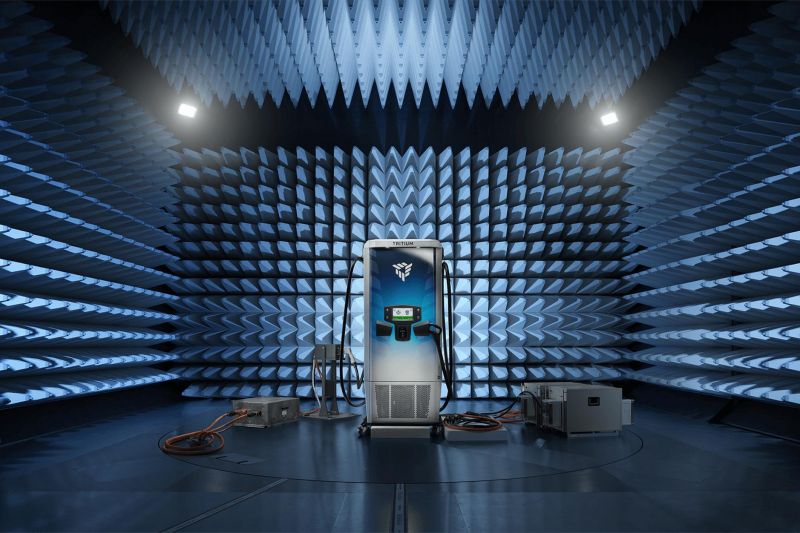

Tritium was founded in 2001 in Brisbane as an engineering consulting firm, and in 2013 introduced its first DC fast charger.

By 2020 it had become a leading provider of DC chargers with a claimed 15 per cent global market share, and the backing of coal barons Trevor St Baker and Brian Flannery.

The next year saw a successful Nasdaq stock listing in 2021, which had Tritium valued at $2 billion.

It inked a deal in January 2023 to supply BP with fast-chargers, and Prime Minister Anthony Albanese called the firm a local example of innovation and success that October.

But in November 2023 it announced it would shutter its Brisbane facility to consolidate manufacturing operations at its Lebanon, Tennessee plant in the US.

It said the move aligned with its plans to be profitable in 2024, but by this point, its share price was on a downward slide.

One investor, Brian Flannery, told The Australian Financial Review at the time that the company had left the factory closure too late.

“The current directors have let it go too far and watched the margins disappear,” Mr Flannery told the AFR.

“They should have bitten the bullet and moved to the United States earlier and kept an R&D [research and development] centre in Brisbane.

“I think they need to find a big backer to take it private. I think taking it private is the only option. I am hoping someone takes them over.”

He reportedly sold his five per cent stake in the firm in February 2024.

Tritium received a deficiency notice from Nasdaq in October 2023 saying the bid price of its ordinary shares had closed below US$1 per share for the previous 30 consecutive days.

In March 2024, it received a delisting determination from Nasdaq as its ordinary shares had a closing bid price of US$0.10 or less for 10 consecutive trading days.

Tritium subsequently did a reverse stock split, with every 200 hundred shares consolidated into one. Subsequently, the firm received a notice from Nasdaq that it didn’t meet the required number of publicly held shares to continue being listed.

Attempts to secure external capital from state and federal governments appear to have been unsuccessful.

Ex-Tritium employees told CarExpert earlier this year, under the condition of anonymity, that the company suffered from poor management, while its products were unreliable.

“There were a lot of design flaws [in the chargers] that were mostly ignored. People at the top refused to make the necessary changes,” one former employee told CarExpert.

“I loved the company and the career progression opportunities that were at hand, but it wasn’t too long until I started to notice the company was losing its spark due to bad management.

“No one wanted to take accountability when things went wrong but rather played the blame game. Issues were never resolved because of that.”

MORE: Electric car chargers ‘flawed’ and faulty – ex-Tritium employees