The current state of global affairs means it’s no sure thing electric vehicles will continue to get cheaper in the near future, reports the International Energy Agency (IEA).

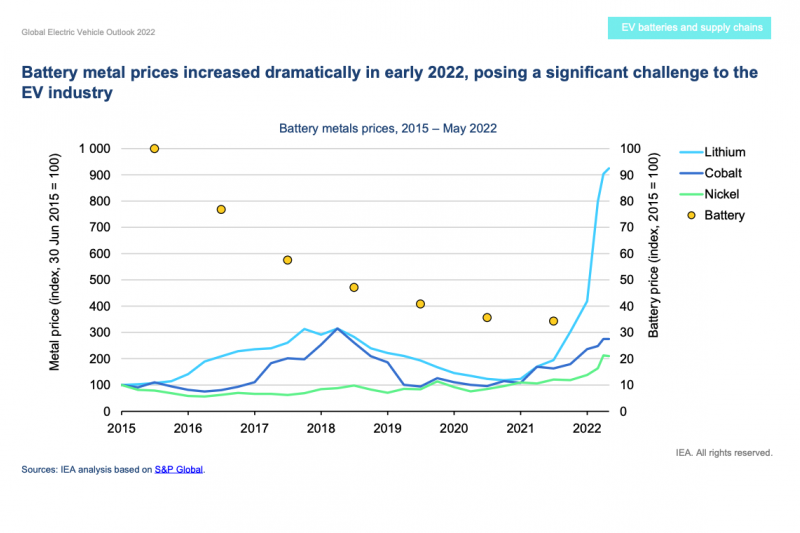

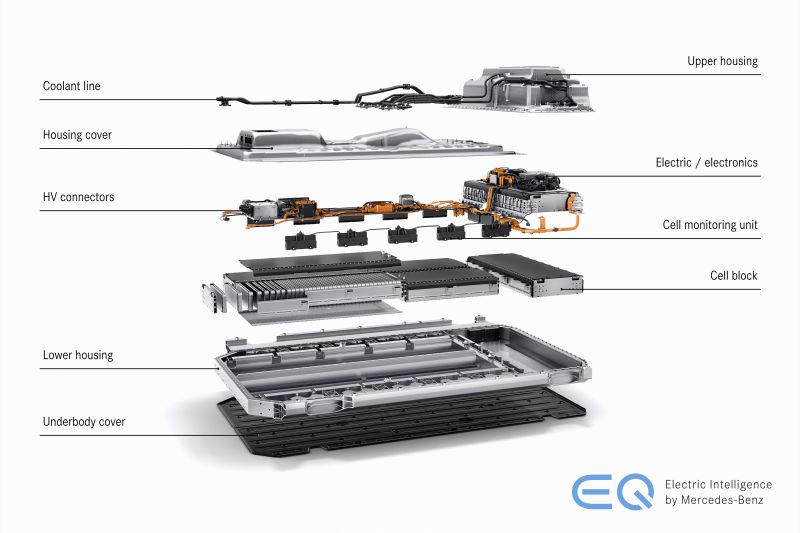

Its most up-to-date 2022 Global EV Outlook report states the prices of raw materials commonly used in batteries such as cobalt, lithium, and nickel have surged. Batteries are the most expensive part of electric vehicles (EVs), so price rises are a natural conclusion to draw.

For example, lithium prices in May 2022 were more than seven times higher than they were at the start of 2021. “Unprecedented” demand for EV batteries as global sales boom, and the cited lack of structural investment in new supply capacity, are listed as driving factors.

Russia’s invasion of Ukraine has created more strife because Russia supplies about 20 per cent of global ‘high-purity’ nickel.

“The rapid increase in EV sales during the pandemic has tested the resilience of battery supply chains, and Russia’s war in Ukraine has further exacerbated the challenge,” the report said.

So while battery prices fell by a stated 6.0 per cent to $US132 per kilowatt-hour in 2021, listed as a slower decline than the 13.0 per cent drop recorded the previous year, there’s no guarantee this cost reduction will continue into 2022.

In fact the agency said if metal prices in 2022 remain as high as they’ve been in the first quarter, then battery packs will become about 15 per cent more expensive than they were in 2021, “all else being equal”.

“However, given the current oil price environment the relative competitiveness of EVs remains unaffected,” the report added. Small consolation!

For some background on the state of the market, global sales of EVs doubled in 2021 to 6.6 million cars, equal to almost 10 per cent of the global new-car sales total

Global sales of electric cars have kept rising strongly in 2022, with about two million sold in the first quarter, up 75 per cent from the same period in 2021.

The increase in EV sales in 2021 was primarily led by China, which accounted for half the growth. The first quarter of 2022 showed similar trends, with sales in China more than doubling, alongside a 60 per cent increase in the US and a 25 per cent increase in Europe.

Diversification of the battery supply chain is considered a key need.

China produces a claimed three-quarters of lithium-ion batteries and is home to some 70 per cent of production capacity for cathodes and 85 per cent of production capacity for anodes. More than half of lithium, cobalt and graphite processing and refining capacity is situated in China, too.

Europe is responsible for a tick over one-quarter of global EV production, but is home to “very little of the supply chain” apart from cobalt processing at 20 per cent.

The USA has an even smaller role in the global EV battery supply chain, with only 10 per cent of EV production and 7.0 per cent of battery production capacity at present.

Both Korea and Japan “have considerable shares of the supply chain downstream of raw material processing”, particularly in cathode and anode material production, the report adds.

Korea is responsible for 15 per cent of cathode material production capacity, while Japan accounts for 14 per cent of cathode and 11 per cent of anode material production.

“Pressure on the supply of critical materials will continue to mount as road transport electrification expands to meet net zero ambitions,” the IEA adds.

“Additional investments are needed in the short term, particularly in mining, where lead times are much longer than for other parts of the supply chain.

“Projected mineral supply until the end of the 2020s is in line with the demand for EV batteries… but the supply of some minerals such as lithium would need to rise by up to one-third by 2030 to match the demand for EV batteries to satisfy the pledges and announcements [made by governments and car-makers].

Demand for lithium is projected to increase sixfold to 500 kilotonnes by 2030, requiring the equivalent of 50 new average-sized mines, the IEA claims.

The mining of raw materials most commonly takes place in resource-rich countries such as Australia, Chile, and the Democratic Republic of Congo, and is handled by a few big multinational companies.

“If current high commodity prices endure, cathode chemistries could shift towards less mineral-intensive options. For example, the lithium iron phosphate chemistry does not require nickel nor cobalt, but comes with a lower energy density and is therefore better suited for shorter-range vehicles,” the agency surmised.

This battery chemistry is particularly big in China; for example the Australia-market Tesla Model 3 (made in Shanghai) which dominates local EV sales uses LFP batteries of this sort.

The maturation of battery recycling, establishing a closed material loop, is also listed as an essential area for more investment