Damion Smy

Last petrol-powered Jaguar built

3 Hours Ago

How did the new car market fare in March, and what are some of the emerging trends, success stories, and issues to watch?

Senior Contributor

Senior Contributor

Utes took all three spots on the podium in March 2023, and the top 10 list of models were all either light commercial vehicles or SUVs rather than traditional hatchbacks and sedans.

The Toyota HiLux, Ford Ranger, and Isuzu D-Max were the the most popular new vehicles last month, ahead of the Mitsubishi Outlander and Tesla Model Y in fourth and fifth.

At a higher level, new vehicle deliveries in Australia fell 3.9 per cent year-on-year in March 2023, to 97,251 units, as ongoing supply problems drag on.

MORE: Australian government tells brands to stop importing contaminated cars

It’s the second-lowest sales figure for the month of March across the last 10 years, with only the COVID-interrupted March of 2020 yielding a lower total.

However sales across the first quarter of 2023 remain higher than they were last year, at 269,002 deliveries (2.5 per cent higher than Q1, 2022).

| Year | March only | Jan-March |

|---|---|---|

| 2023 | 97,251 | 269,002 |

| 2022 | 101,233 | 262,436 |

| 2021 | 100,005 | 263,648 |

| 2020 | 81,690 | 233,361 |

| 2019 | 99,442 | 268,538 |

| 2018 | 106,988 | 291,538 |

| 2017 | 105,410 | 279,345 |

| 2016 | 104,512 | 285,328 |

| 2015 | 105,054 | 277,594 |

| 2014 | 97,267 | 266,370 |

“March was a solid month for new car sales given the supply constraints car makers are facing both domestically and internationally,” said Federal Chamber of Automotive Industries chief executive Tony Weber.

These supply constraints are no longer only down to a lack of semiconductor chips in overseas factories, but also due to the current crisis at some of Australia’s ports, which are battling through biosecurity-related blockages.

“Year to date sales have increased 2.5 per cent which is a better indicator of the underlying strength of the market,” contended Mr Weber.

Battery electric vehicle sales grew by 19.5 per cent on March 2022 figures along with plug-in-hybrids (PHEVs) which increased by 33.3 per cent.

Market leader Toyota had a shocker as it continued to navigate lack of supply, with its March sales tumbling 39.4 per cent over the same month in 2022. Ergo its market share fell to just 13.6 per cent, against an average above 20 per cent.

Key models that suffered included the Camry (down 40 per cent), Corolla (down 48 per cent), HiAce (down 50 per cent), Kluger and Prado (each down 59 per cent), RAV4 (down 61 per cent) and Yaris Cross (down 46.3 per cent). Even the HiLux fell 29 per cent in 4×4 guise.

Number-two brand Mazda likewise declined, in this case by 26.7 per cent to 8243 sales, with a near 50 per cent drop in CX-5 sales doing the most damage.

Ford nabbed third place on the charts with 6485 sales and 52.8 per cent growth, though it’s worth also pointing out that some 85 per cent of its deliveries were either Rangers or Everests.

Rounding out the top five were Kia (up 5.8 per cent) and Mitsubishi (down 34.9 per cent). Completing the top 10 were Hyundai (down 17.6 per cent), Isuzu Ute (up 37.1 per cent), MG (up 1.1 per cent as its growth rate plateaus), Subaru (up 69 per cent), and Tesla (down 19 per cent).

Smaller-volume brands that outperformed the market and showed good growth rates include, in alphabetical order:

Audi (up 49.4 per cent), BMW (up 56.7 per cent), Chevrolet (up 32.5 per cent), GWM/Haval (up 268 per cent), LDV (up 40.9 per cent), Lexus (up 32.5 per cent), Mini (up 164.2 per cent), Polestar (up 84.3 per cent), Ram Trucks (up 46.8 per cent), SsangYong (up 147 per cent), and Volkswagen (up 22.7 per cent).

Brands that went backwards include Alfa Romeo (down 32.8 per cent), Jeep (down 24.2 per cent), Porsche (down 41.8 per cent), Renault (down 20.1 per cent), Skoda (down 10.1 per cent), and Suzuki (down 25.1 per cent).

| Brand | Sales | Change |

|---|---|---|

| Toyota | 13,223 | Down 39.4% |

| Mazda | 8243 | Down 26.7% |

| Ford | 6485 | Up 52.8% |

| Kia | 6403 | Up 5.8% |

| Mitsubishi | 5863 | Down 34.9% |

| Hyundai | 5369 | Down 17.6% |

| Isuzu Ute | 4534 | Up 37.1% |

| MG | 4007 | Up 1.1% |

| Subaru | 3852 | Up 69.0% |

| Tesla | 3578 | Down 19.0% |

| Volkswagen | 3476 | Up 22.7% |

| Nissan | 3404 | Up 7.4% |

| GWM | 3338 | Up 268.0% |

| BMW | 2858 | Up 56.7% |

| Mercedes-Benz | 2774 | Up 0.5% |

| LDV | 1954 | Up 40.9% |

| Audi | 1770 | Up 49.4% |

| Honda | 1608 | Up 6.6% |

| Suzuki | 1518 | Down 25.1% |

| Lexus | 1133 | Up 32.5% |

| BYD | 1061 | N/A |

| Volvo Car | 1017 | Down 2.5% |

| Renault | 705 | Down 20.1% |

| Ram | 681 | Up 46.8% |

| Land Rover | 677 | Down 6.7% |

| Skoda | 644 | Down 10.1% |

| SsangYong | 536 | Up 147.0% |

| Jeep | 519 | Down 24.2% |

| Mini | 457 | Up 164.2% |

| Cupra | 449 | N/A |

| Porsche | 425 | Down 41.8% |

| Chevrolet | 224 | Up 32.5% |

| Polestar | 212 | Up 84.3% |

| Peugeot | 199 | Up 13.7% |

| Fiat | 184 | Up 13.6% |

| Genesis | 69 | Up 15.0% |

| Jaguar | 55 | Down 50.5% |

| Alfa Romeo | 41 | Down 32.8% |

| Maserati | 35 | Down 40.7% |

| Citroen | 23 | Down 32.4% |

| Aston Martin | 22 | Up 120.0% |

| Ferrari | 16 | Down 20.0% |

| Bentley | 12 | Down 50.0% |

| McLaren | 6 | Up 50.0% |

| Rolls-Royce | 4 | Down 20.0% |

| Lotus | 3 | Down 83.3% |

| Lamborghini | 1 | Down 87.5% |

A look at the top 25 nameplates reveals the dominance of work and lifestyle utes, which occupied the top three places and six in the overall list. There were also eight medium-sized SUVs in the top 25.

More intriguingly there are just four vehicles classified as neither SUV nor ute, with the top-seller among them being the Tesla Model 3, ahead of the Hyundai i30, MG 3, and Toyota Corolla.

Sales by region

Category breakdown

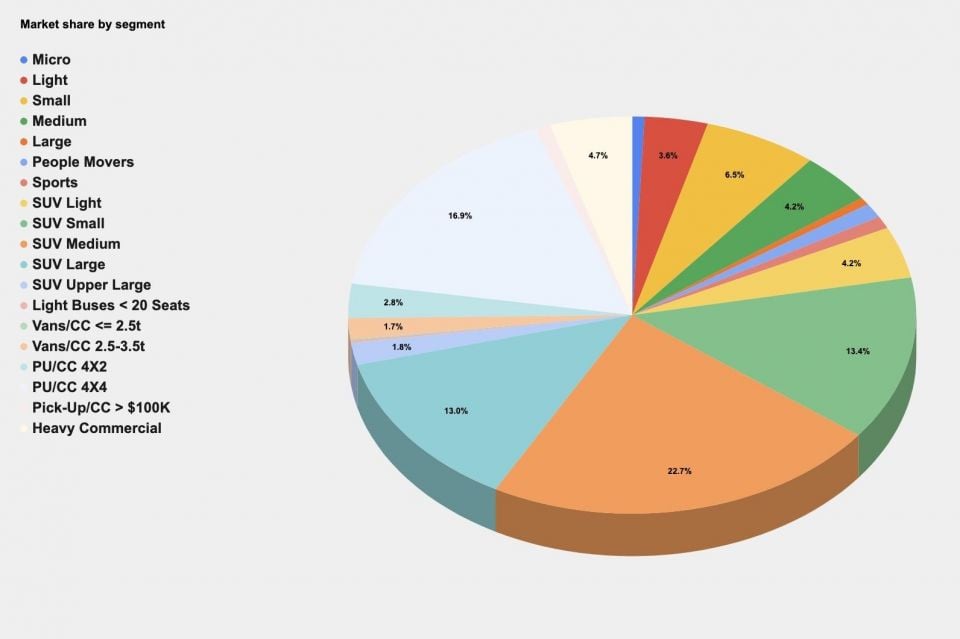

Top segments by market share

Sales by buyer type

Sales by propulsion or fuel type

Sales by country of origin

Got any questions about car sales? Ask away in the comments and we’ll jump in!

Damion Smy

3 Hours Ago

Josh Nevett

5 Hours Ago

Josh Nevett

5 Hours Ago

Damion Smy

6 Hours Ago

CarExpert.com.au

6 Hours Ago

James Wong

7 Hours Ago