Derek Fung

Tesla redesigning interior door handles likely due to safety concerns

4 Hours Ago

Today's Australia-wide sales data shows new vehicle sales dipped 13 per cent in July 2020, with the lion's share of that drop coming from Victoria. Toyota's RAV4 was easily the top-selling vehicle.

Senior Contributor

Senior Contributor

After showing some signs of recovery in June, Australia’s new vehicle sales took a bigger hit in July, declining 12.8 per cent.

VFACTS data posted today shows 72,505 new vehicles were counted as sold during the year’s seventh month – 10,679 fewer cars than July last year.

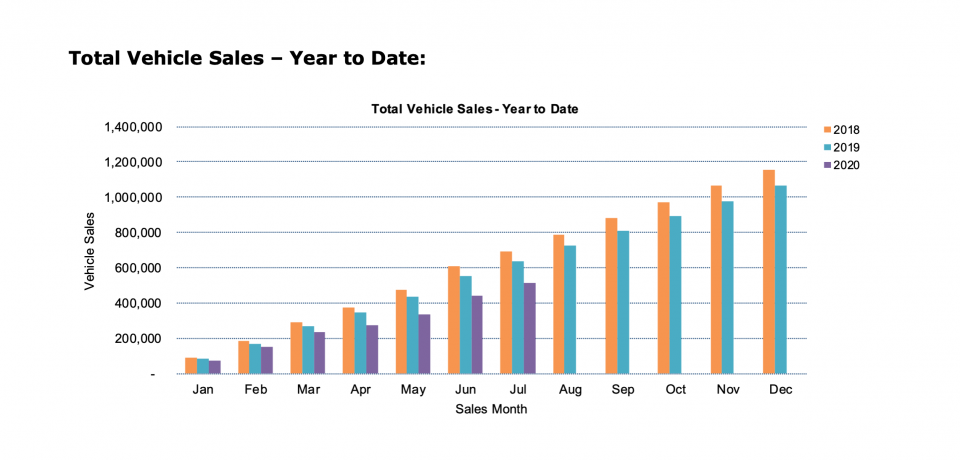

While sales have been battered by the pandemic – year-to-date down nearly 20 per cent – they were down ‘only’ 6.4 per cent in June by comparison, after a 35 per cent decline in May and 48.5 per cent fall in April.

As you might expect, the biggest decline last month came from the heavily-populated state of Victoria, which is now in Stage 4 lockdown in response to community transmission of COVID-19.

Sales there diminished by 27.8 per cent to 17,487 units, equivalent to 6743 fewer cars being sold compared to July 2019’s tally.

That means more than 60 per cent of the national sales decline can be pinned on Victoria. With Victorian dealerships regulated to close their doors for six weeks, things won’t turn any time soon.

Sales also declined heavily in New South Wales (down 7.8 per cent or 2046 cars), Queensland (down 9.1 per cent or 1526 cars), and Tasmania (down 22.6 per cent or 378 cars).

By contrast, sales in South Australia fell 5.0 per cent (252 cars), in Western Australia just 1 per cent (74 cars), and in the Northern Territory 4.5 per cent (31 cars). Sales in the Australian capital Territory actually grew 30.6 per cent, equal to 371 cars.

There were 19 car brands that recorded positive sales results in July, but only two were among the top 10 (Kia and Volkswagen).

Market-leader Toyota owned 21.4 per cent market share, despite sales declining 13.2 per cent to 15,508. It made three of the top-four-selling vehicles.

Mazda was clear in second thanks to strong sales growth from the CX-3, CX-8, runout BT-50, and all-new CX-30.

A tight four-way race between Mitsubishi, Hyundai (down a whopping 33.6 per cent), Kia, and Ford accounted for the next four positions. More than two-thirds of Ford’s sales were Rangers.

The new T-Cross helped Volkswagen to seventh, ahead of Mercedes-Benz’s combined car and van brands (MB passenger 2556, commercial 650). Rounding out the top 10 were Nissan and Subaru.

Smaller-volume players that grew sales compared to July 2019 included (in finishing order): Suzuki (up 26.8 per cent), Audi (up 53.3 per cent), MG (up 58.8 per cent), LDV (up 22.4 per cent), Volvo Car (up 23.1 per cent), Jeep (up 19.5 per cent), and Haval (up 139.3 per cent).

| Brand | July sales | % change |

|---|---|---|

| Toyota | 15,508 | -13.2 |

| Mazda | 7806 | -5.1 |

| Mitsubishi | 4684 | -10.7 |

| Hyundai | 4634 | -33.6 |

| Kia | 4625 | +2.6 |

| Ford | 4573 | -6.7 |

| Volkswagen | 3710 | +2.8 |

| Mercedes-Benz | 3206 | -1.4 |

| Nissan | 2906 | -23.6 |

| Subaru | 2864 | -18.5 |

| Honda | 2199 | -25.2 |

| Suzuki | 1475 | +26.8 |

| Isuzu Ute | 1327 | -29.9 |

| Audi | 1315 | +53.3 |

| MG | 1115 | +58.8 |

| Holden | 1113 | -65.9 |

| BMW | 1011 | -42.5 |

| LDV | 722 | +22.4 |

| Volvo Car | 692 | +23.1 |

| Skoda | 651 | -4.8 |

| Renault | 559 | -3.1 |

| Lexus | 527 | -29.5 |

| Jeep | 509 | +19.5 |

| Haval | 335 | +139.3 |

| Land Rover | 306 | -40 |

| Peugeot | 290 | +16.5 |

| RAM | 280 | +7.3 |

| Porsche | 230 | -29.4 |

| Mini | 200 | -20.9 |

| SsangYong | 196 | +62 |

| Great Wall | 170 | +41.7 |

| Fiat | 125 | -25.2 |

| Alfa Romeo | 94 | +67.9 |

| Jaguar | 80 | -42.9 |

| Maserati | 53 | +65.6 |

| Chrysler | 23 | +27.8 |

| Genesis | 22 | +/-0 |

| Ferrari | 12 | -53.8 |

| Lamborghini | 12 | +140 |

| Citroen | 10 | -71.4 |

| Aston Martin | 8 | -46.7 |

| Bentley | 8 | +/-0 |

| McLaren | 8 | +100 |

| Rolls-Royce | 8 | +33.3 |

| Lotus | 3 | -25 |

The Toyota RAV4 wasn’t just the most popular SUV, it was the most popular vehicle. Greater supply has enabled Toyota to at least partially clear its backlog.

Number two in the market was the Ford Ranger, nudging ahead of the Toyota HiLux which was deep into runout mode, with an update set to launch next month. The Toyota Corolla and Hyundai i30 completed the top five.

From the top 20 list, there were 11 SUVs (three small, seven medium-sized, one large), four pickups/utes, and five passenger vehicles (four small cars, and one medium).

| Model | July sales | % change |

|---|---|---|

| Toyota RAV4 | 4309 | +78.1 |

| Ford Ranger | 3104 | -2.1 |

| Toyota HiLux | 2947 | -12.3 |

| Toyota Corolla | 2192 | -32.4 |

| Hyundai i30 | 1745 | -22.5 |

| Mazda CX-5 | 1727 | -20 |

| Mitsubishi Triton | 1593 | +4.5 |

| Mazda CX-3 | 1355 | +5.4 |

| Toyota Camry | 1281 | -19.8 |

| Mazda 3 | 1224 | -35.4 |

| Kia Cerato | 1207 | -29.9 |

| Nissan X-Trail | 1116 | -26.4 |

| Hyundai Tucson | 1087 | -26.5 |

| Toyota Kluger | 1057 | +29.5 |

| Mitsubishi ASX | 1053 | -33.7 |

| Mazda BT-50 | 1012 | +6.5 |

| Kia Sportage | 994 | -8.2 |

| Mazda CX-30 | 990 | New |

| Mitsubishi Outlander | 989 | -16.5 |

| Subaru Forester | 967 | -33.8 |

Passenger vehicles (swipe to see whole table)

| Segment | First | Second | Third |

|---|---|---|---|

| Micro | Kia Picanto: 337 | Mitsubishi Mirage: 113 | Fiat 500: 44 |

| Light | MG3: 571 | Suzuki Swift: 369 | Volkswagen Polo: 365 |

| Light Lux | Mini: 102 | Audi A1: 47 | Citroen C3: 4 |

| Small | Toyota Corolla: 2192 | Hyundai i30: 1745 | Mazda3: 1224 |

| Small Lux | Mercedes A-Class: 588 | Audi A3: 331 | BMW 1 Series: 98 |

| Medium | Toyota Camry: 1281 | Skoda Octavia: 192 | Mazda6: 122 |

| Medium Lux | Mercedes C-Class: 299 | Mercedes CLA: 236 | BMW 3 Series: 84 |

| Large | Kia Stinger: 197 | Holden Commodore: 103 | Skoda Superb: 40 |

| Large Lux | Mercedes E-Class: 67 | BMW 5 Series: 40 | Audi A6: 17 |

| Upper | Chrysler 300: 23 | Mercedes S-Class: 20 | BMW 8 Series GC: 14 |

| MPVs | Kia Carnival: 369 | Honda Odyssey: 86 | LDV G10: 62 |

| Sports < $200k | Ford Mustang: 279 | Mercedes C-Class: 92 | Hyundai Veloster: 72 |

| Sports > $200k | Porsche 911: 32 | BMW 8 Series coupe: 14 | Ferrari range: 12 |

SUVs (swipe to see whole table)

| Segment | First | Second | Third |

|---|---|---|---|

| Light | Mazda CX-3: 1355 | Volkswagen T-Cross: 344 | Hyundai Venue: 282 |

| Small | Mitsubishi ASX: 1053 | Mazda CX-30: 990 | Kia Seltos: 930 |

| Small Lux | Audi Q3: 226 | Volvo XC40: 215 | Audi Q2: 137 |

| Medium | Toyota RAV4: 4309 | Mazda CX-5: 1727 | Nissan X-Trail: 1116 |

| Medium Lux | Mercedes GLC/Coupe: 562 | BMW X3/X4: 299 | Audi Q5: 297 |

| Large | Toyota Kluger: 1057 | Toyota Prado: 779 | Isuzu MU-X: 622 |

| Large Lux | Mercedes GLE/Coupe: 276 | BMW X5/X6: 125 | Volkswagen Touareg: 113 |

| Upper | Toyota L’Cruiser: 479 | Nissan Patrol: 105 | |

| Upper Lux | BMW X7: 65 | Mercedes GLS: 64 | Land Rover Discovery: 39 |

Light commercial vehicles (swipe to see whole table)

| Segment | First | Second | Third |

|---|---|---|---|

| Buses | Toyota HiAce: 165 | Toyota Coaster: 21 | Mercedes Sprinter: 6 |

| Small vans | Volkswagen Caddy: 151 | Renault Kangoo: 68 | peugeot Partner: 32 |

| Mid vans | Toyota HiAce: 353 | Ford Transit Custom: 200 | Renault Trafic: 139 |

| Big vans | Mercedes Sprinter: 214 | Volkswagen Crafter: 124 | Renault Master: 121 |

| 4×2 utes | Toyota HiLux: 896 | Ford Ranger: 305 | Mazda BT-50: 272 |

| 4×4 utes | Ford Ranger: 2799 | Toyota HiLux: 2051 | Mitsubishi Triton: 1392 |

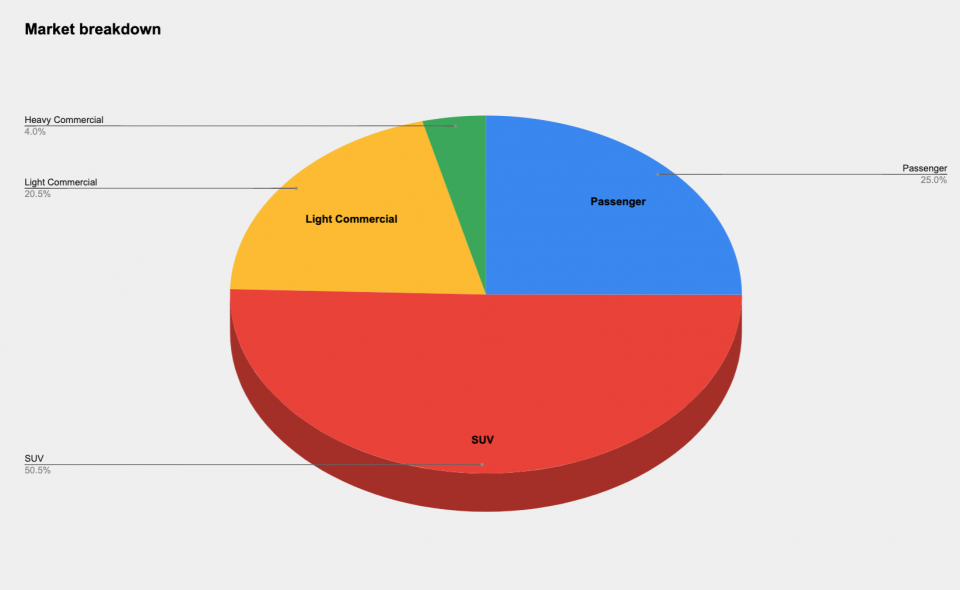

More than 50 per cent of the total market (50.4 per cent) were SUVs. Passenger vehicles made up a mere 25 per cent of the market, light commercials 20.5 per cent, and heavy commercials 4 per cent.

Private buyers accounted for 37,501 sales, business fleets 28,127, government departments 2633, and rentals just 1356 (down an unsurprising 53.4 per cent).

From the total sales mix, there were 42,728 petrol vehicles sold, 19,944 diesels, 6665 hybrids (up 115.5 per cent, with 80 per cent of RAV4s sold being petrol-electric), 138 EVs excluding Tesla that doesn’t submit sales data, and 132 PHEVs.

The main sources of vehicles were Japan (24,456, down 12.9 per cent), Thailand (16,150, down 19.2 per cent), Korea (9489, down 18.6 per cent), Germany (4671, down 25.6 per cent), the USA (2933, down 5.8 per cent), and China (2357, up 51.9 per cent).

If you have any questions – perhaps you want to know how your car did – ask in the comments and a member of the CarExpert team will respond.

MORE: Jan-Jun sales MORE: June sales MORE: May sales MORE: April sales

Derek Fung

4 Hours Ago

Josh Nevett

5 Hours Ago

Josh Nevett

5 Hours Ago

Damion Smy

11 Hours Ago

Ben Zachariah

1 Day Ago

Andrew Maclean

1 Day Ago